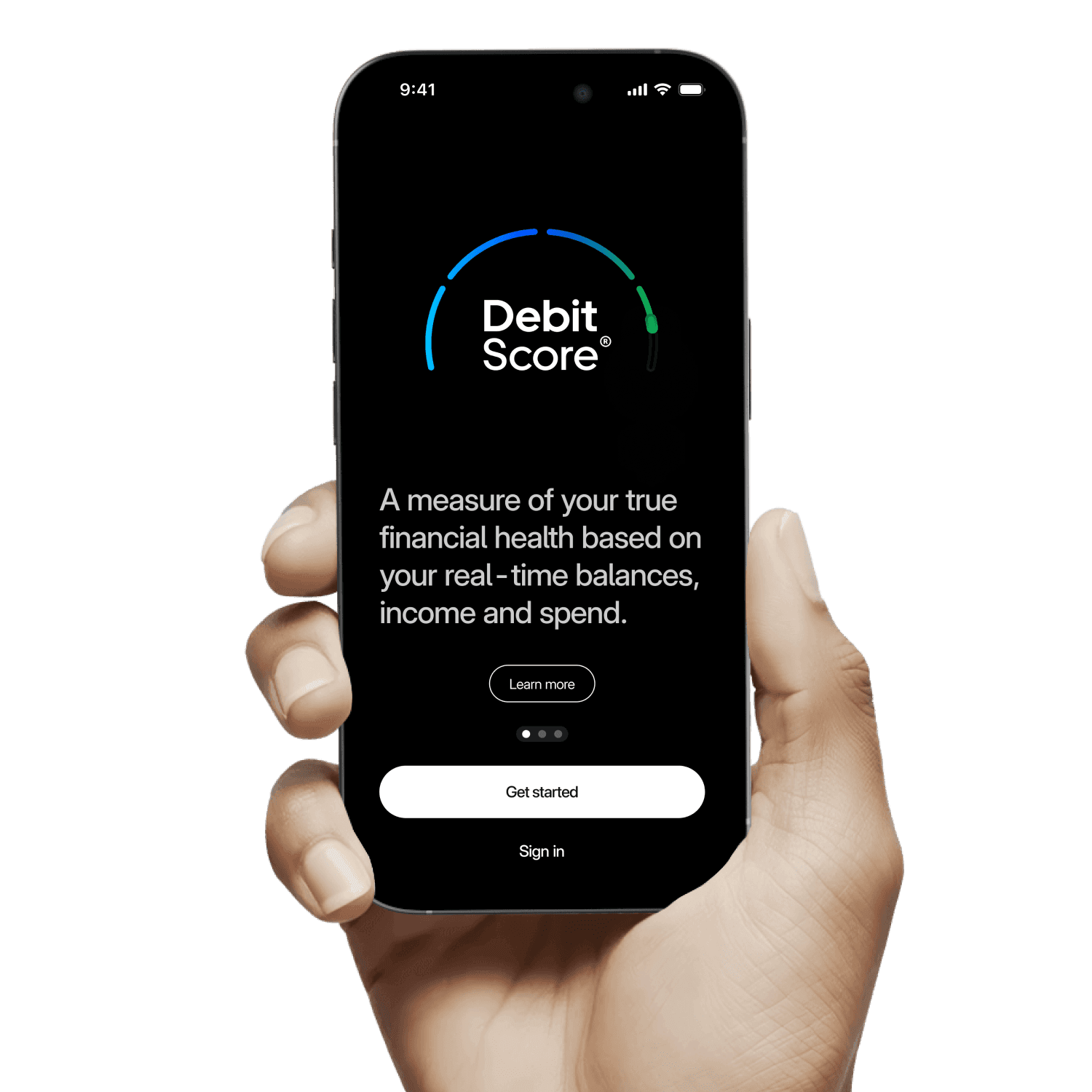

See what credit scores don’t

Your real affordability, based on how you actually manage money.

Not your past borrowing.

Launching in the UK • Free to use • Opt-in only

Works using secure Open Banking by connecting accounts from:

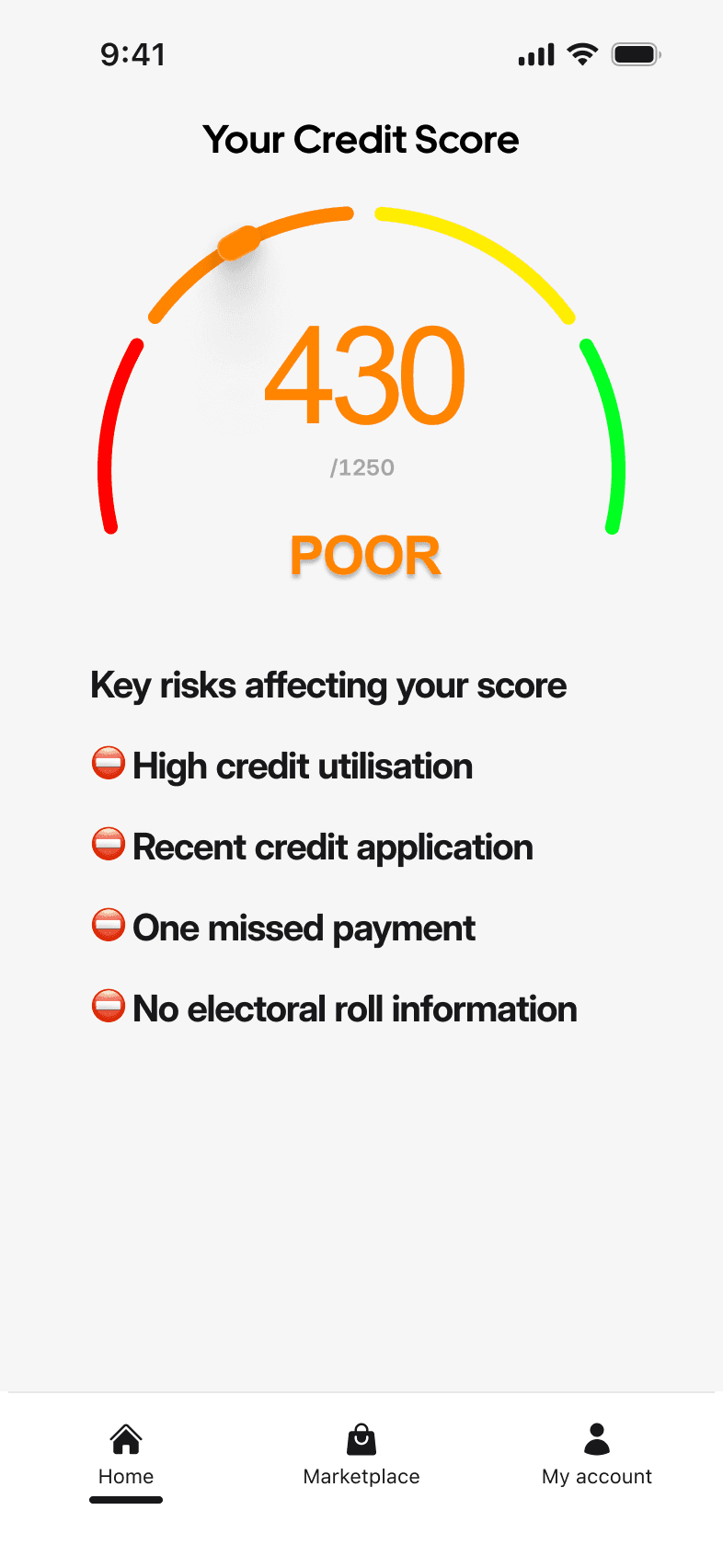

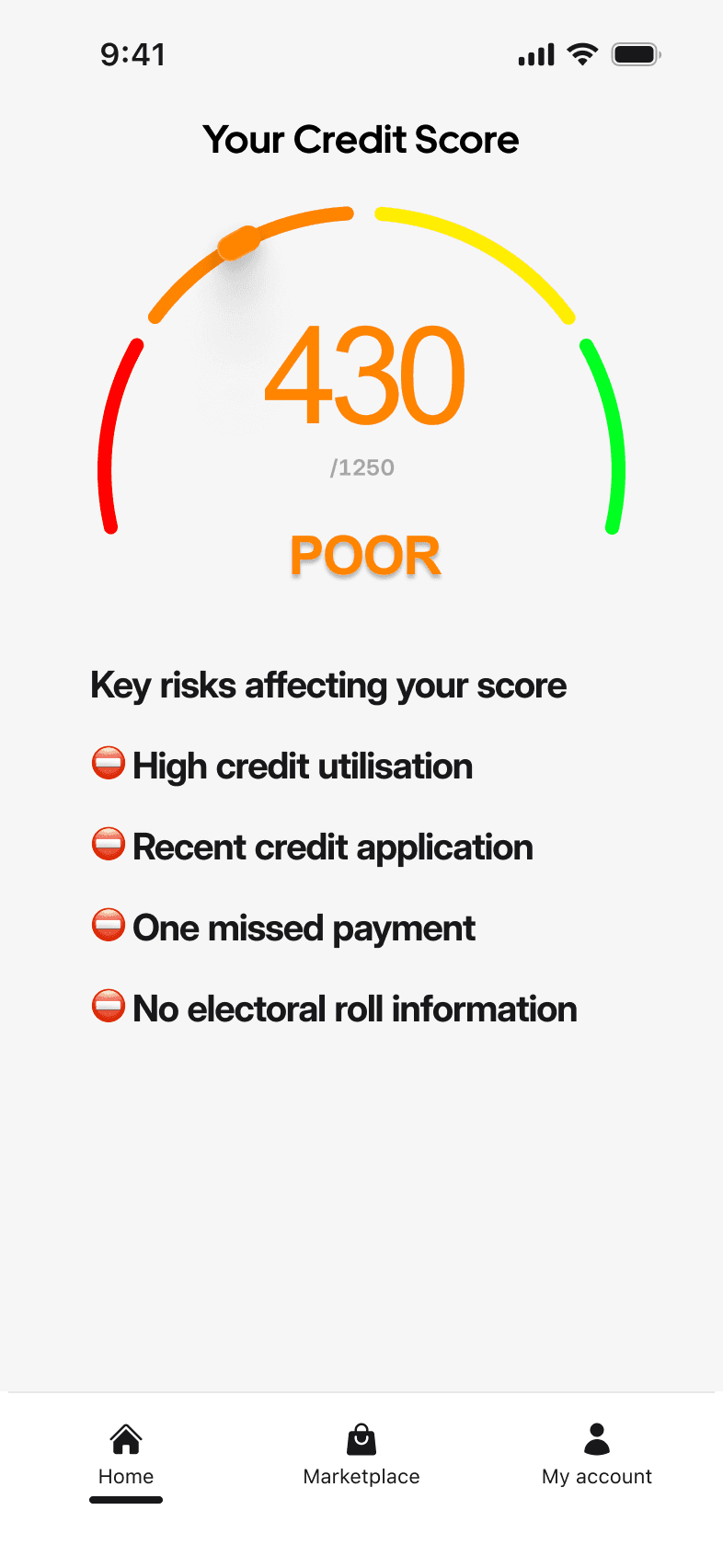

Why credit scores don’t tell the full story

Credit scores look backwards. They focus on loans, cards, and missed payments - not whether you can actually afford things today. That means:

Why credit scores don’t tell the full story

Credit scores look backwards. They focus on loans, cards, and missed payments - not whether you can actually afford things today. That means:

Why credit scores don’t tell the full story

Credit scores look backwards. They focus on loans, cards, and missed payments - not whether you can actually afford things today. That means:

Good money habits go unnoticed

You can manage your money well and still be locked out.

Good money habits go unnoticed

You can manage your money well and still be locked out.

Good money habits go unnoticed

You can manage your money well and still be locked out.

You’re stuck in a catch-22

You need credit to build a score, but a score to get credit.

You’re stuck in a catch-22

You need credit to build a score, but a score to get credit.

You’re stuck in a catch-22

You need credit to build a score, but a score to get credit.

Small mistakes linger for years

One missed payment can follow you long after you’ve recovered.

Small mistakes linger for years

One missed payment can follow you long after you’ve recovered.

Small mistakes linger for years

One missed payment can follow you long after you’ve recovered.

Life not reflected in real time

Your circumstances change, but your score doesn’t keep up.

Life not reflected in real time

Your circumstances change, but your score doesn’t keep up.

Life not reflected in real time

Your circumstances change, but your score doesn’t keep up.

Watch: Why this needed to change

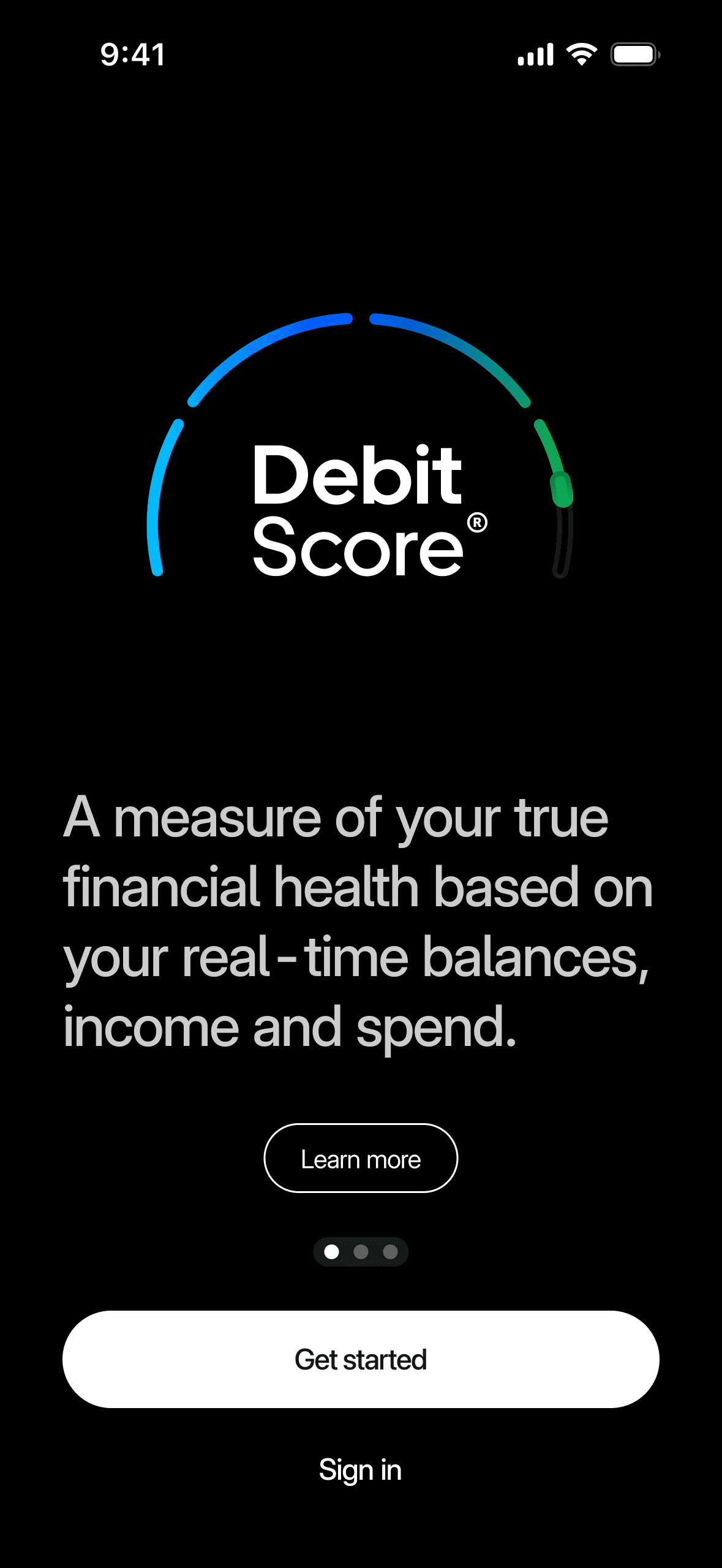

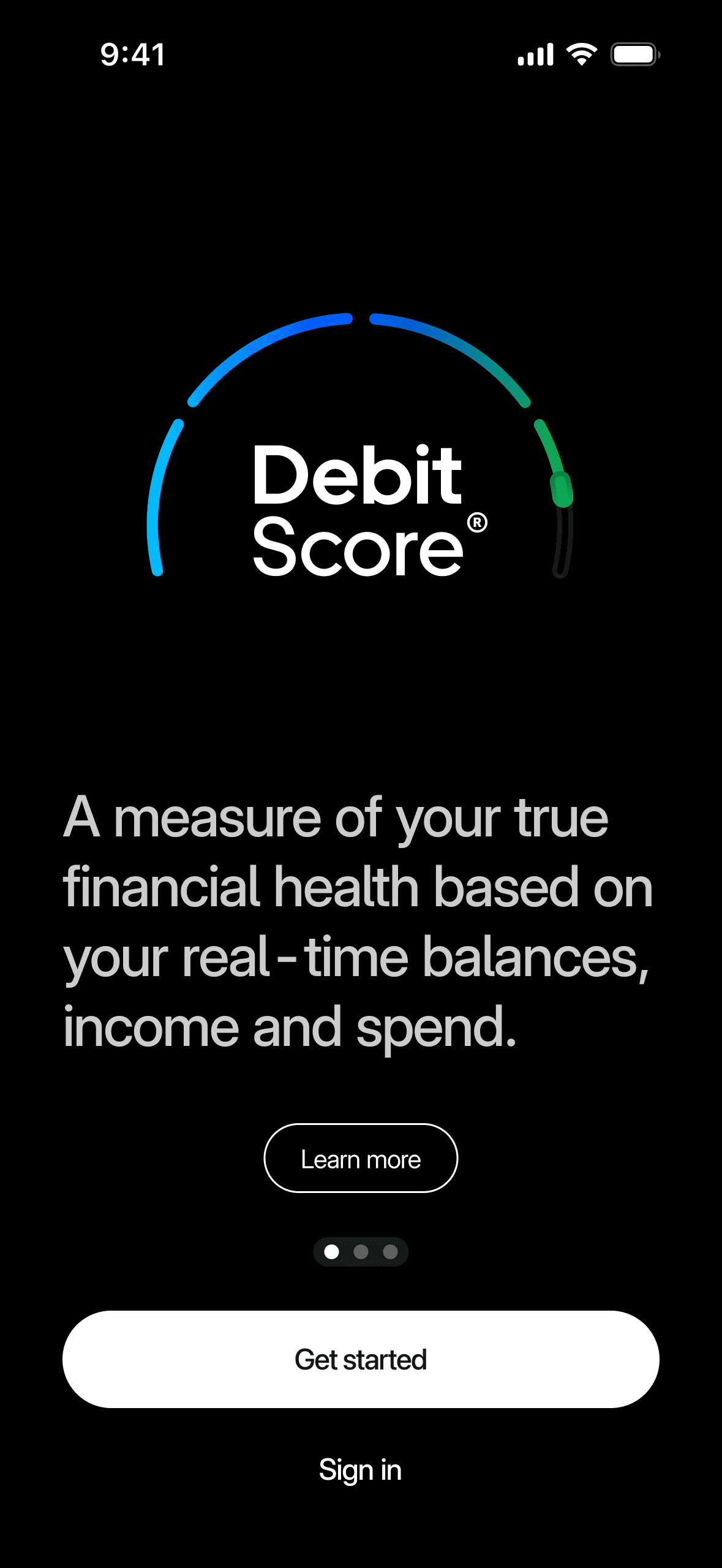

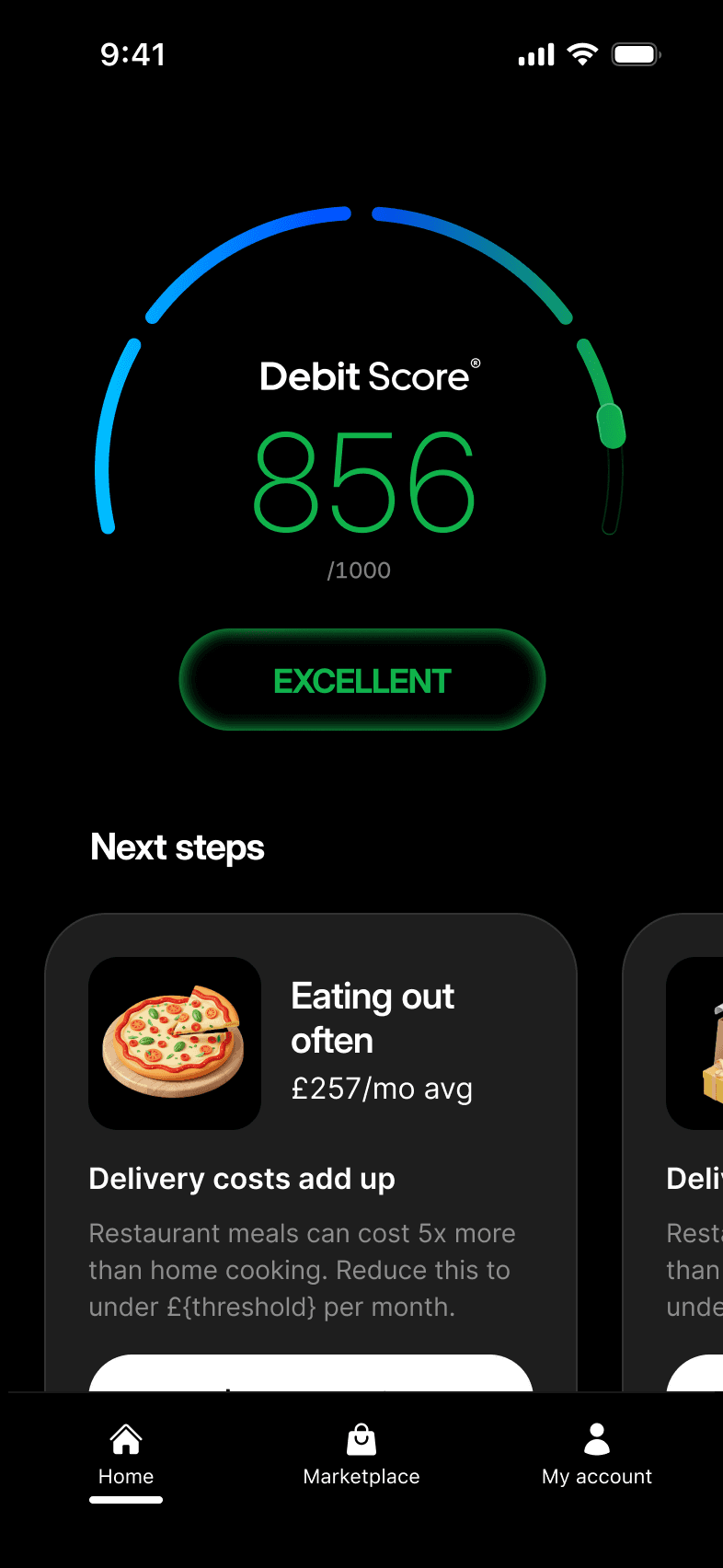

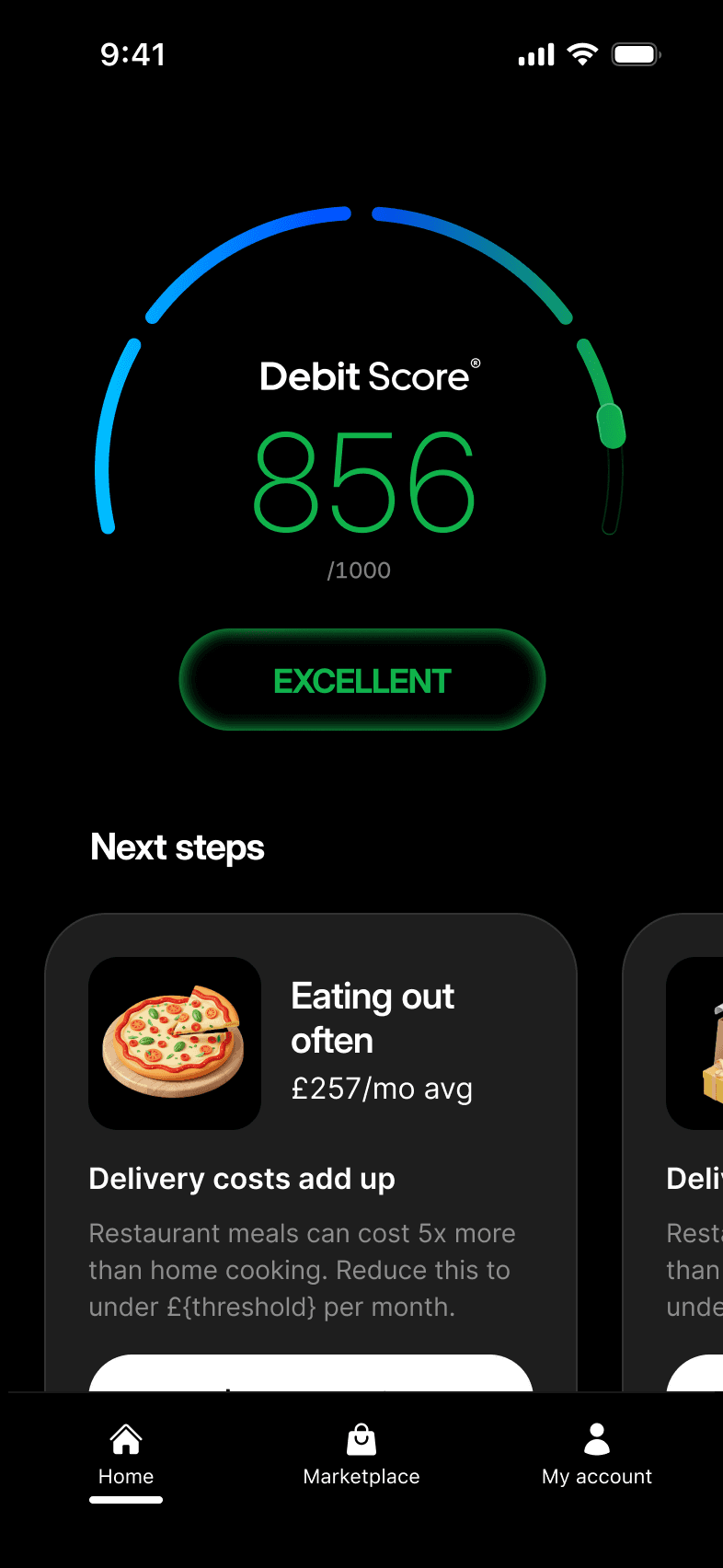

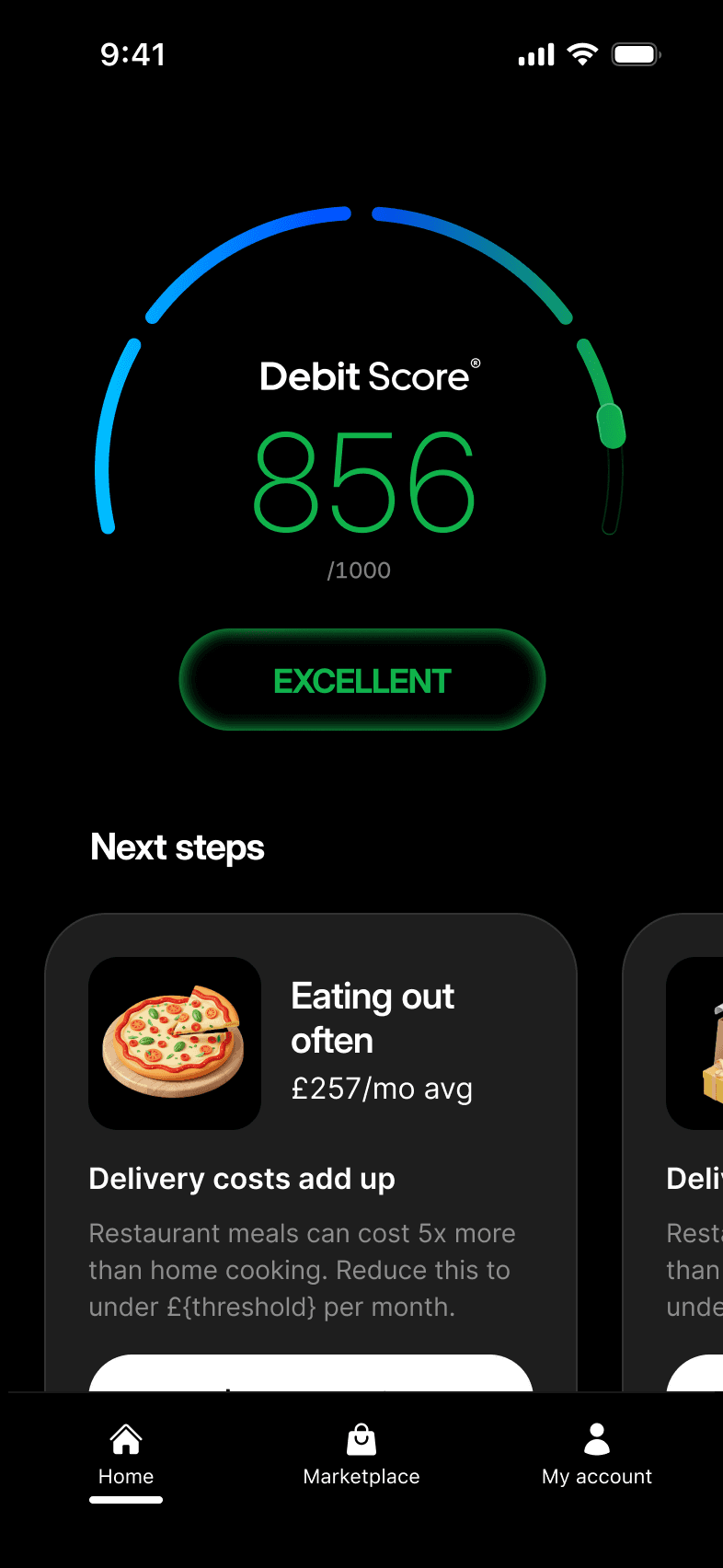

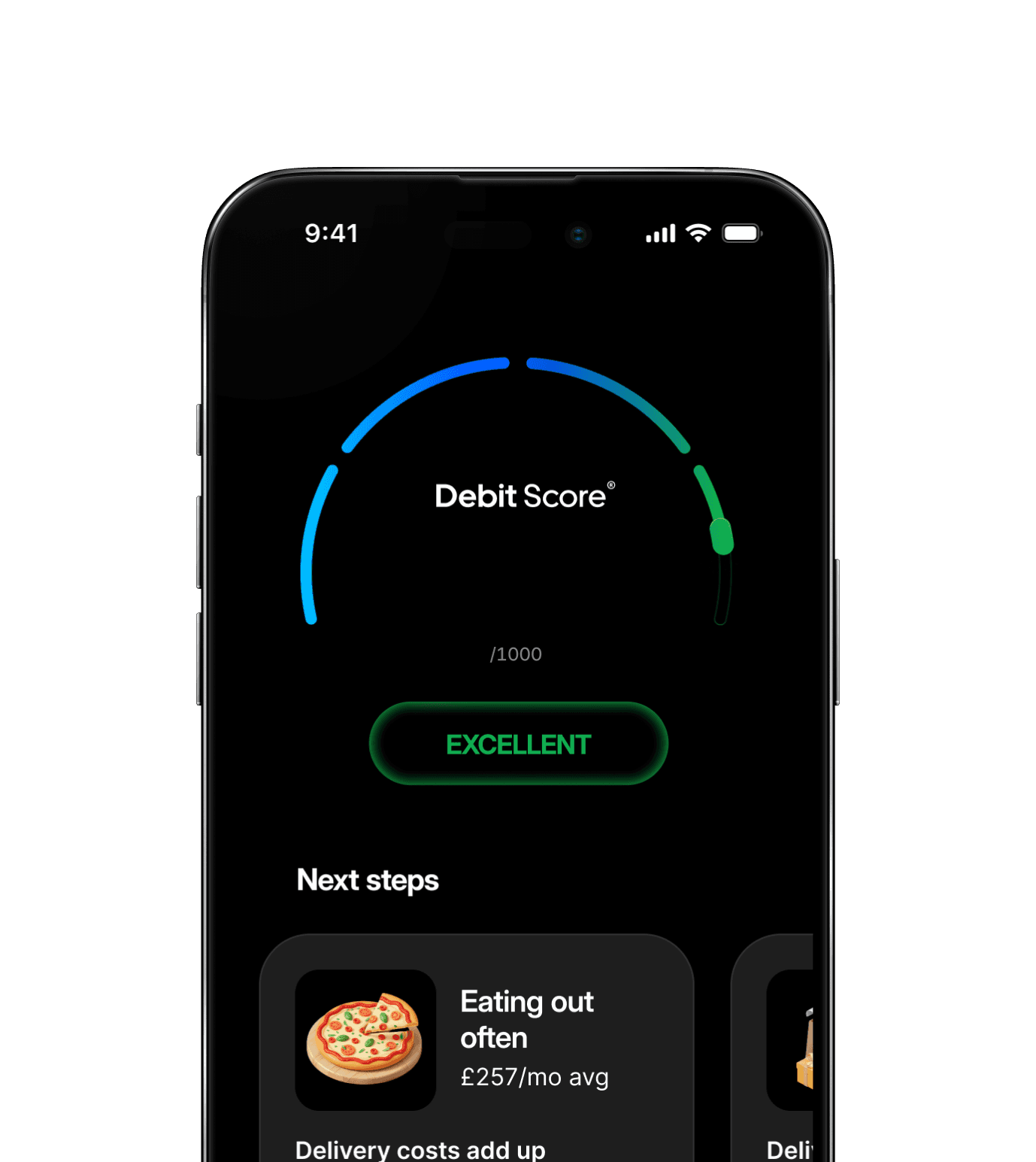

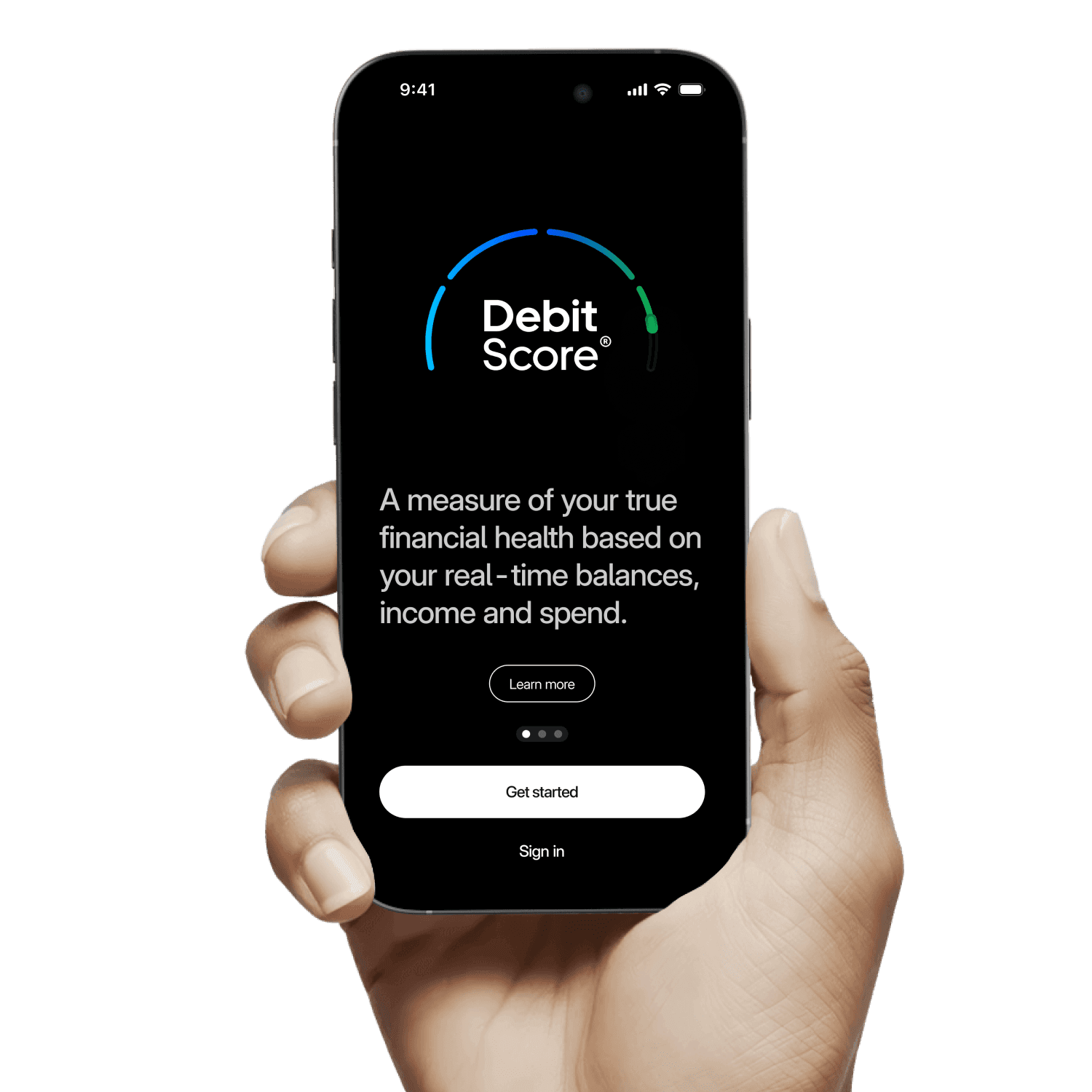

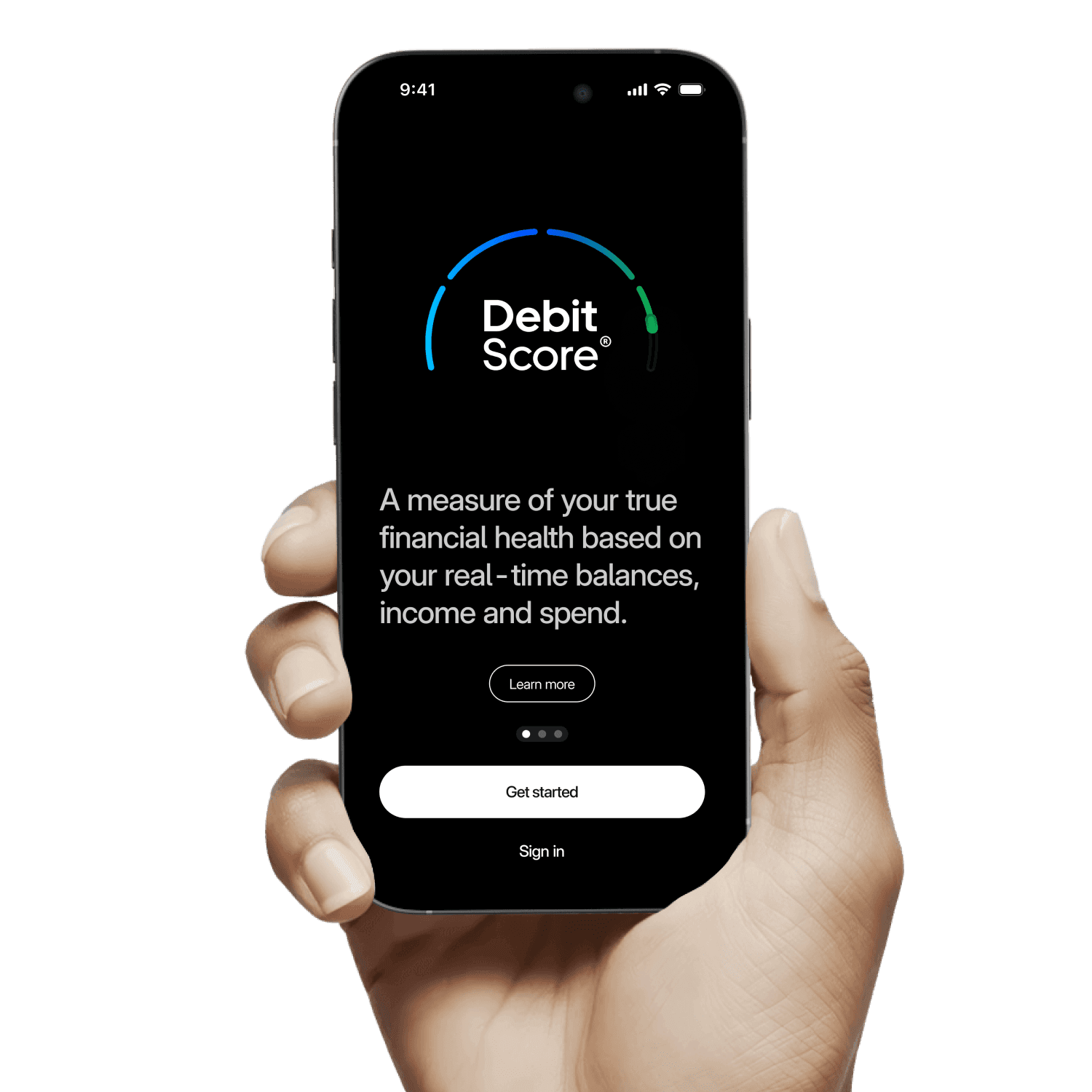

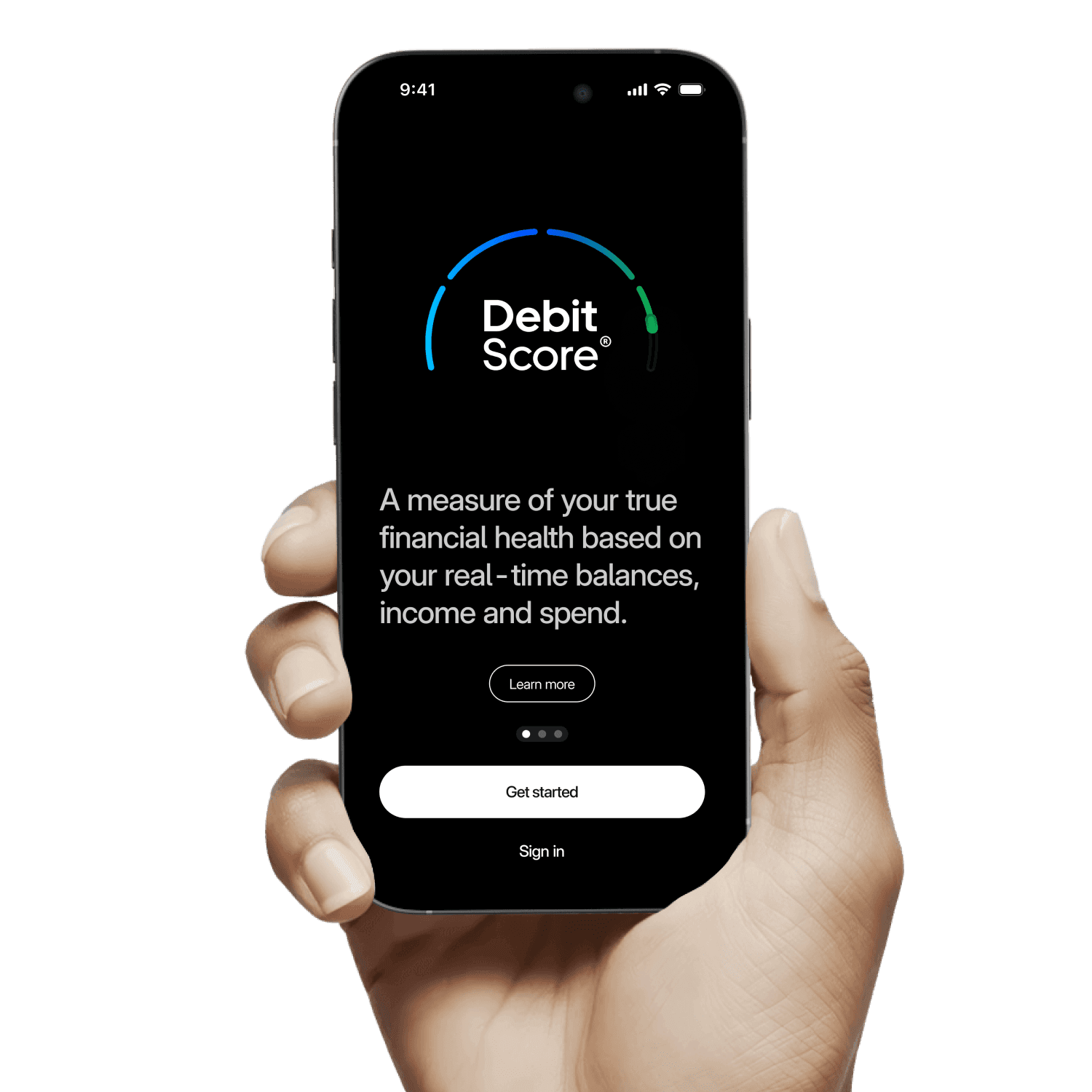

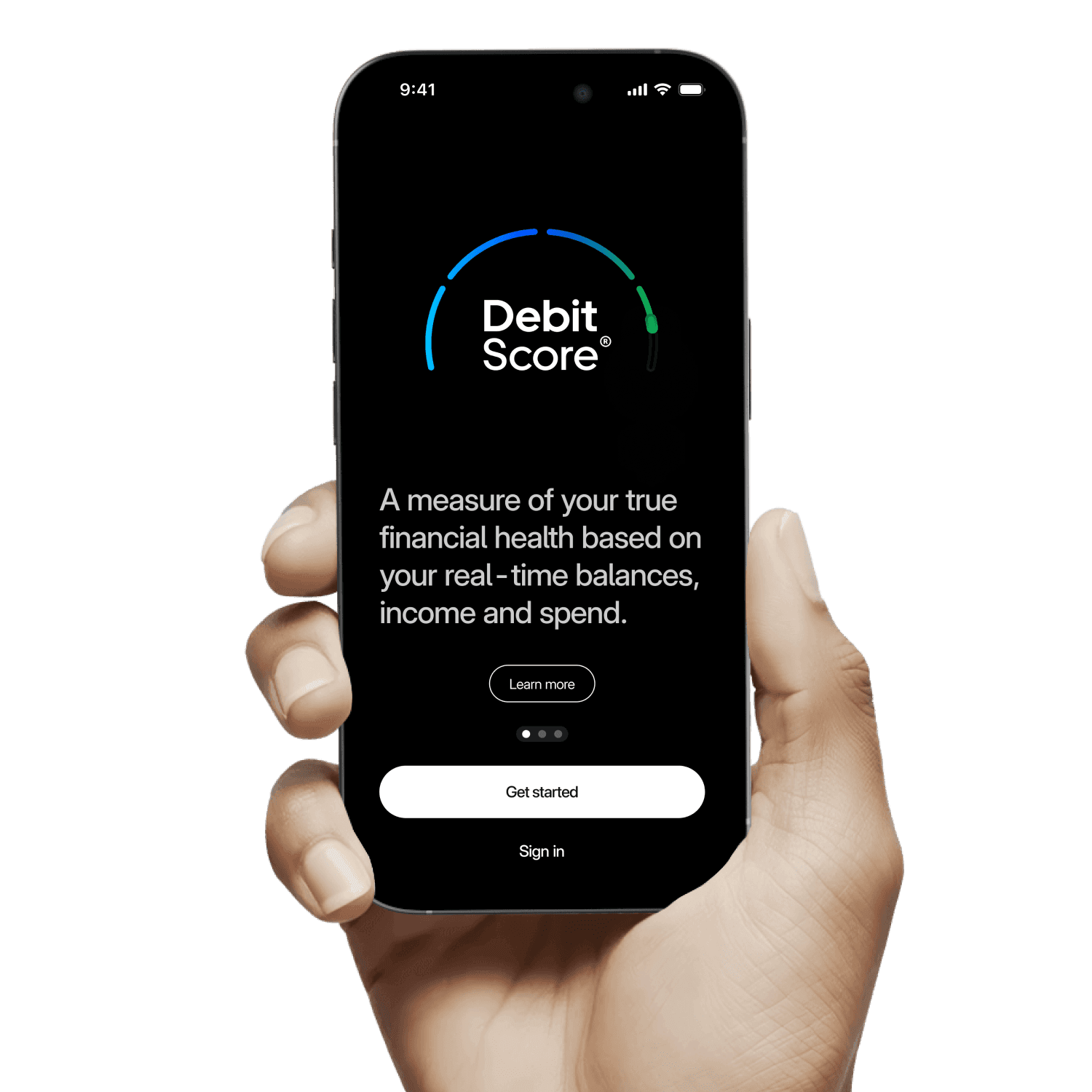

So, what is Debit Score?

So, what is Debit Score?

So, what is Debit Score?

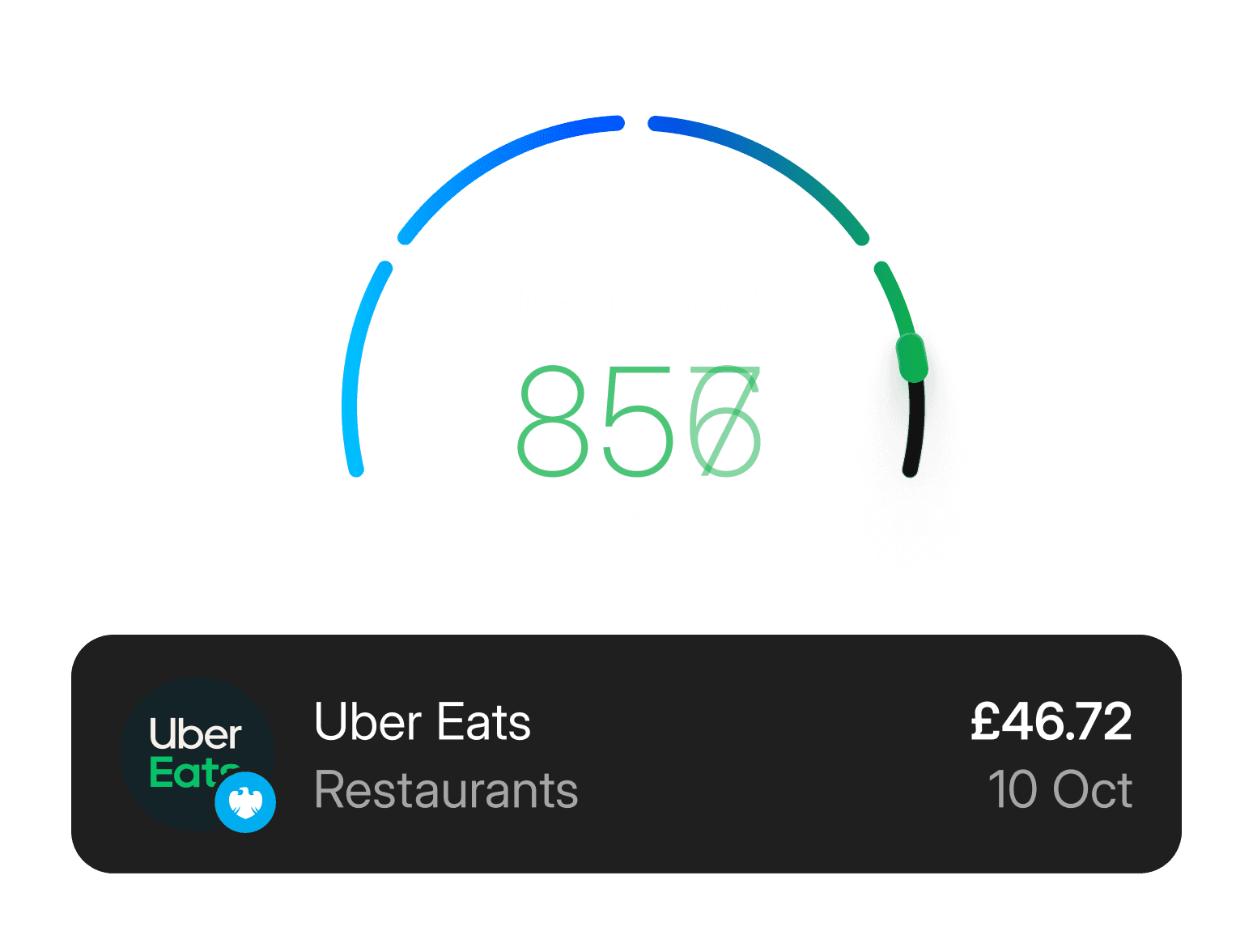

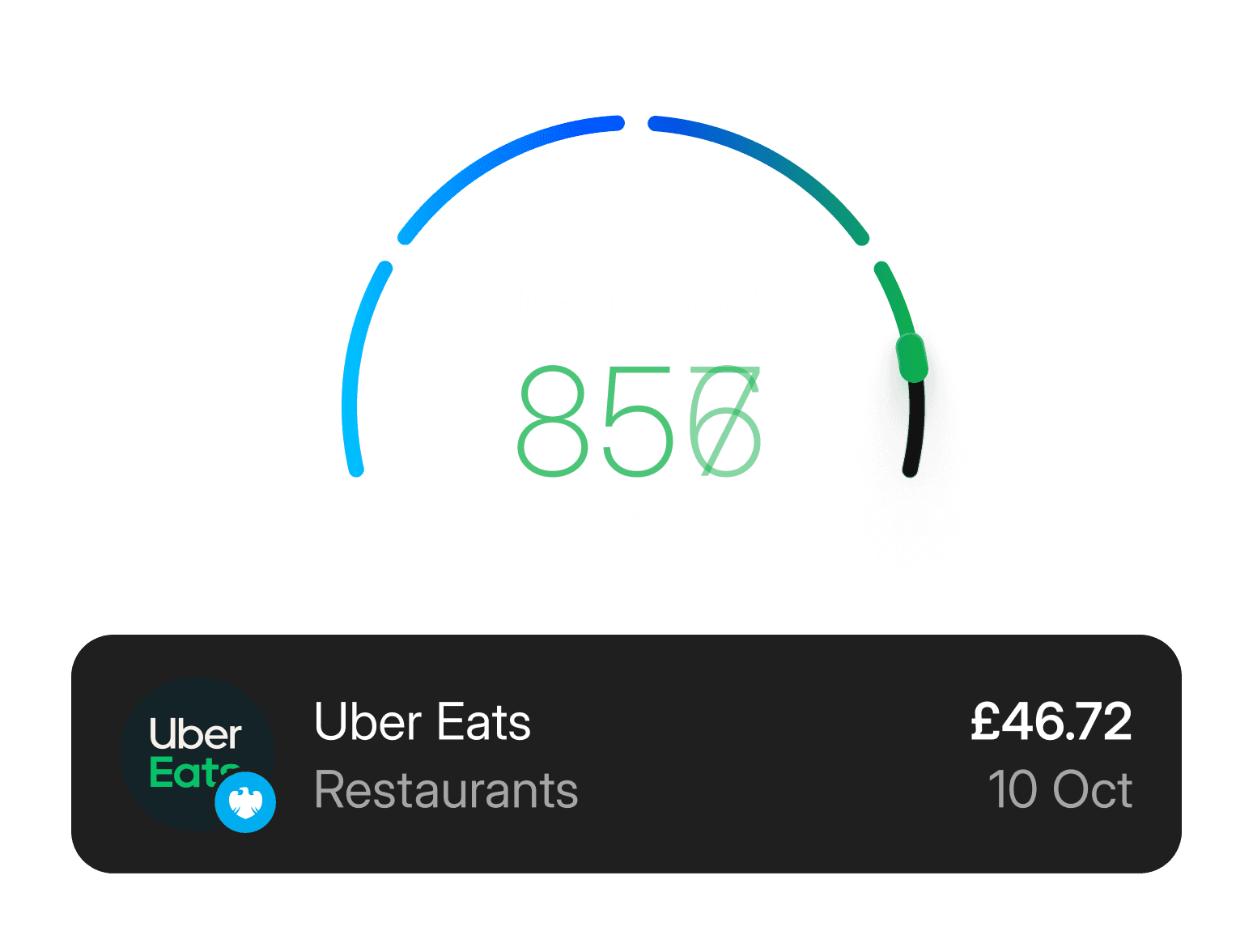

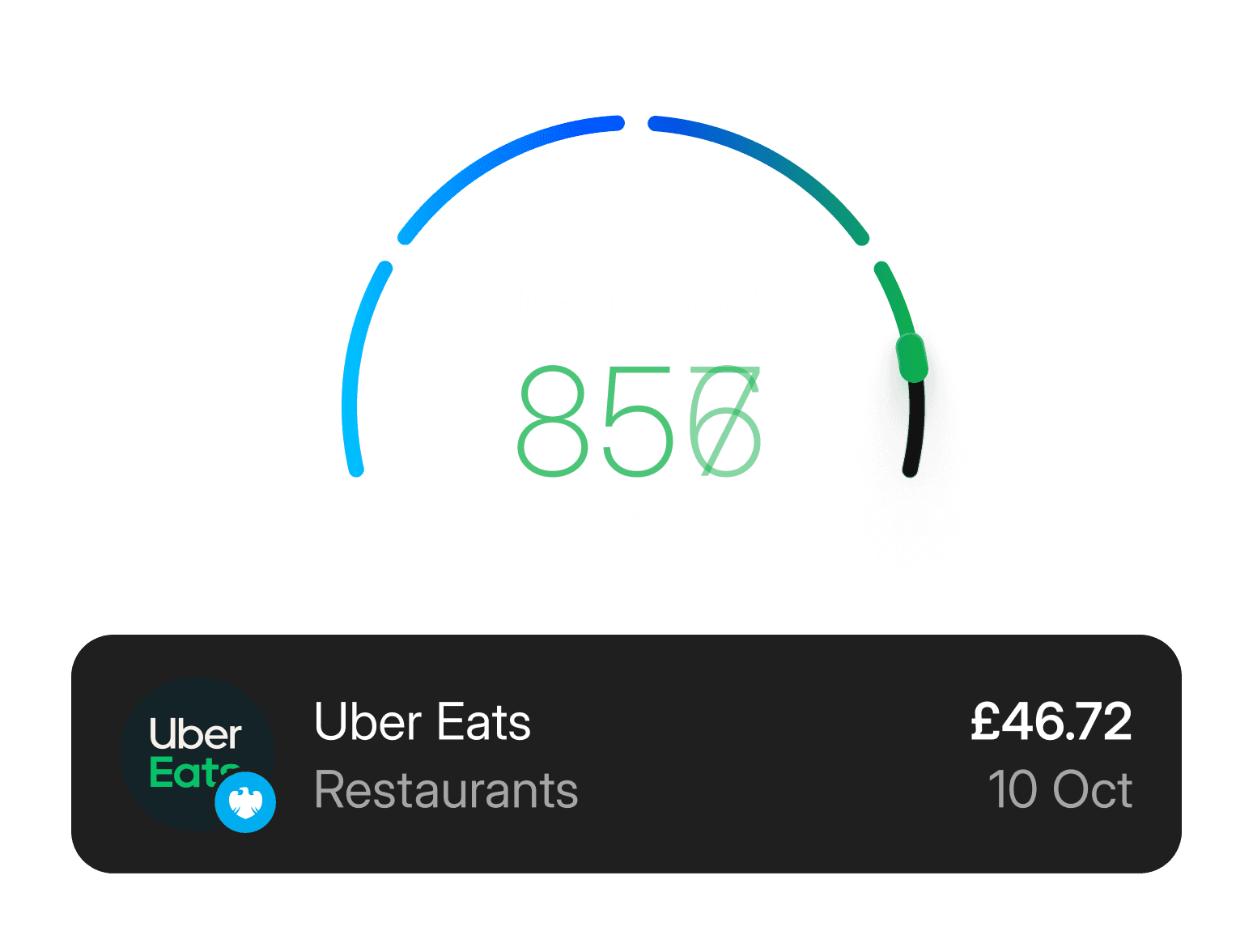

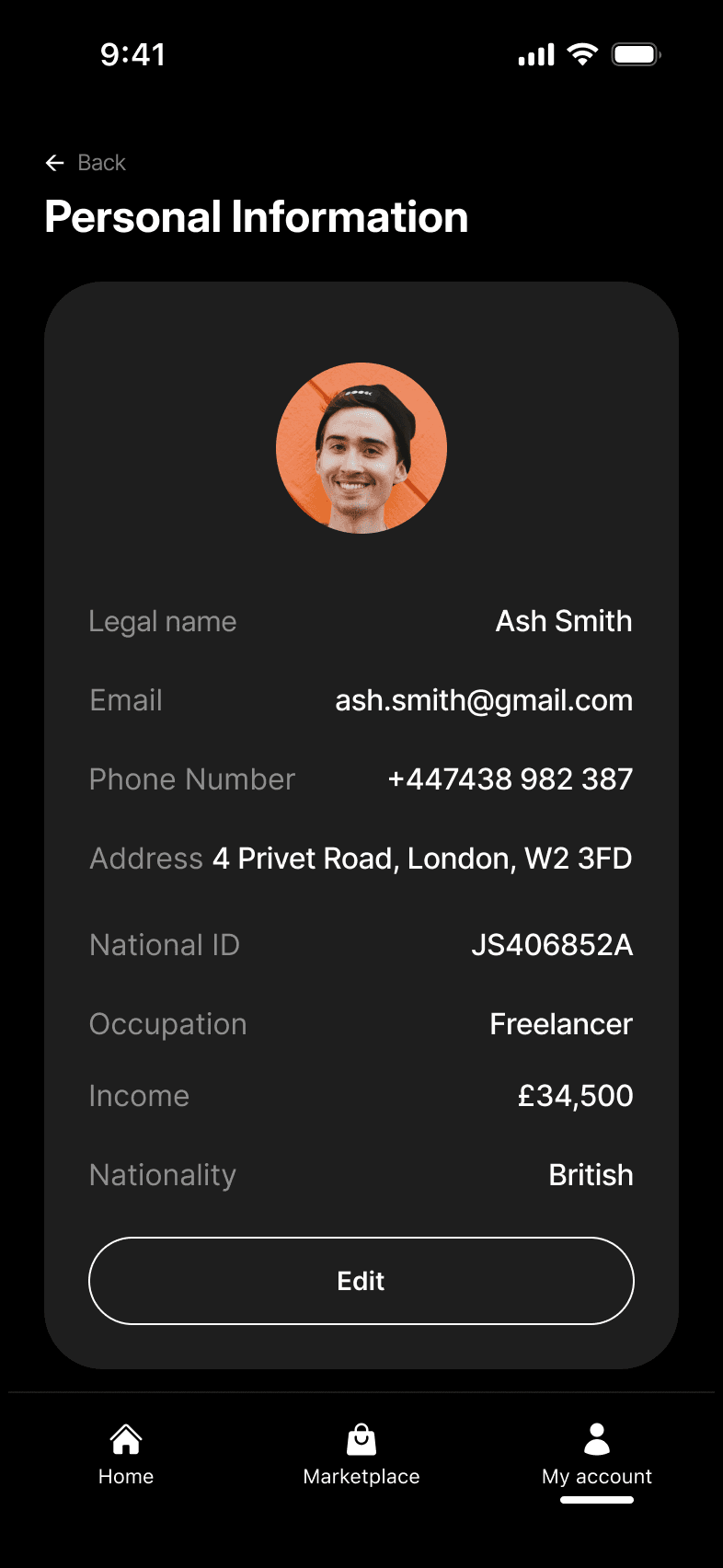

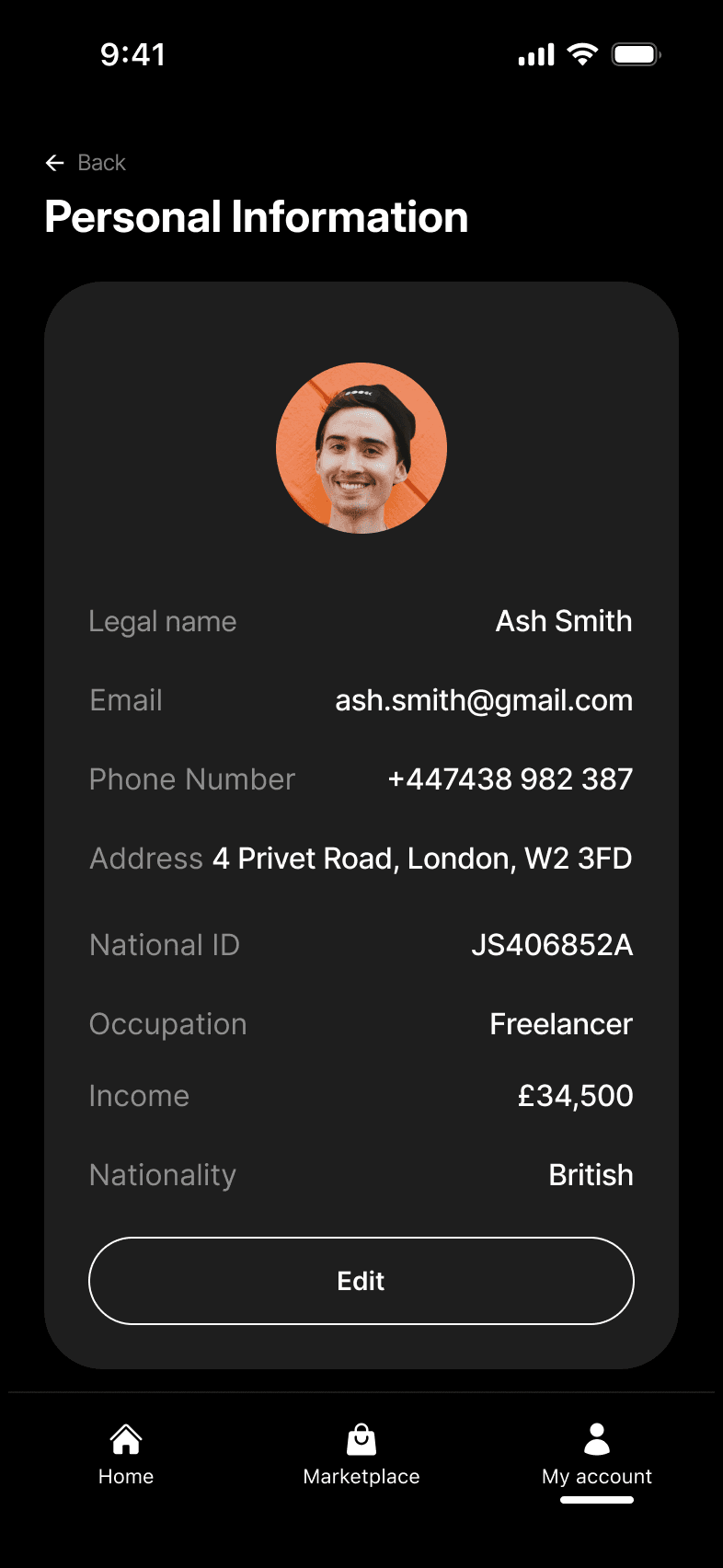

Debit Score is a live view of your affordability and financial resilience.

It looks at:

Debit Score is a live view of your affordability and financial resilience.

It looks at:

Debit Score is a live view of your affordability and financial resilience.

It looks at:

Income & stability

How money comes in — and how reliable it is month to month.

Income & stability

How money comes in — and how reliable it is month to month.

Income & stability

How money comes in — and how reliable it is month to month.

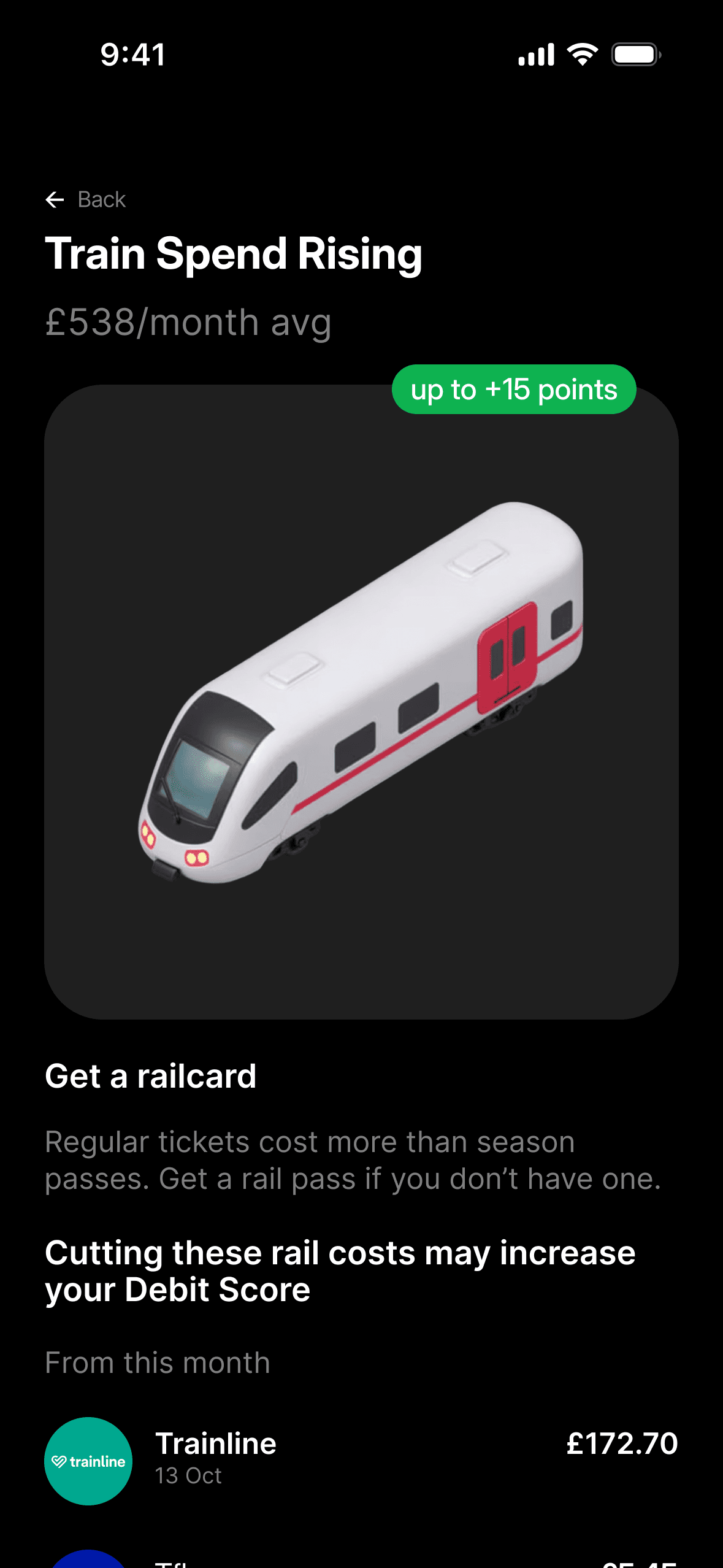

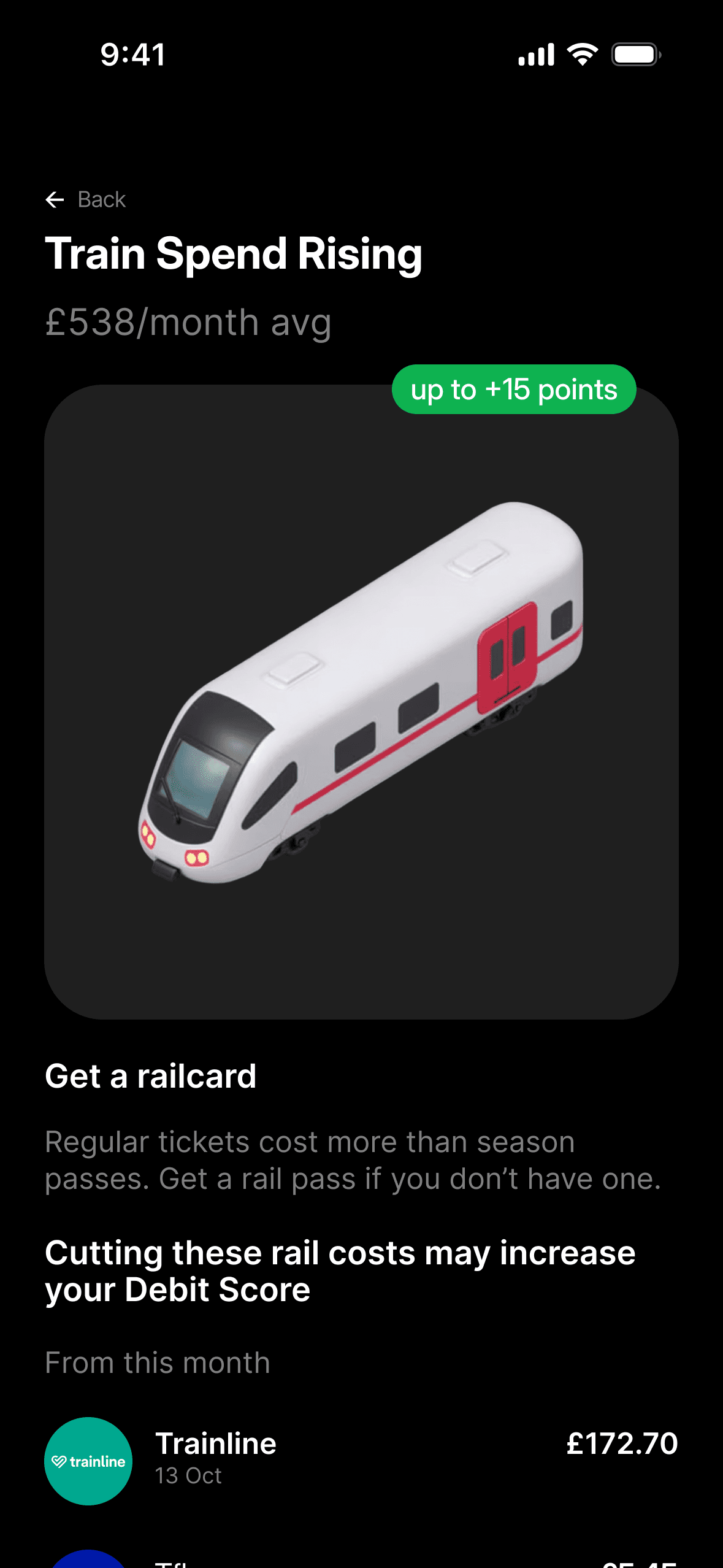

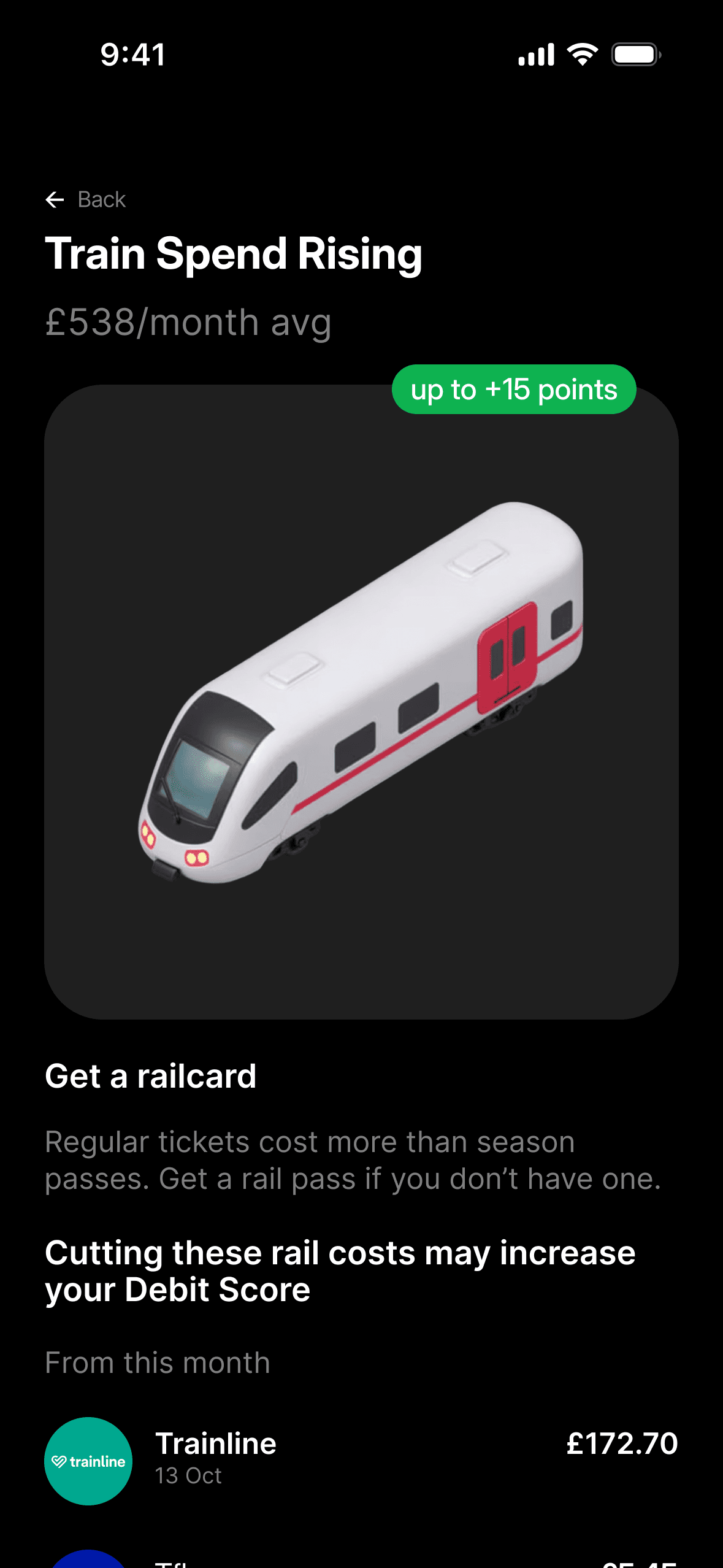

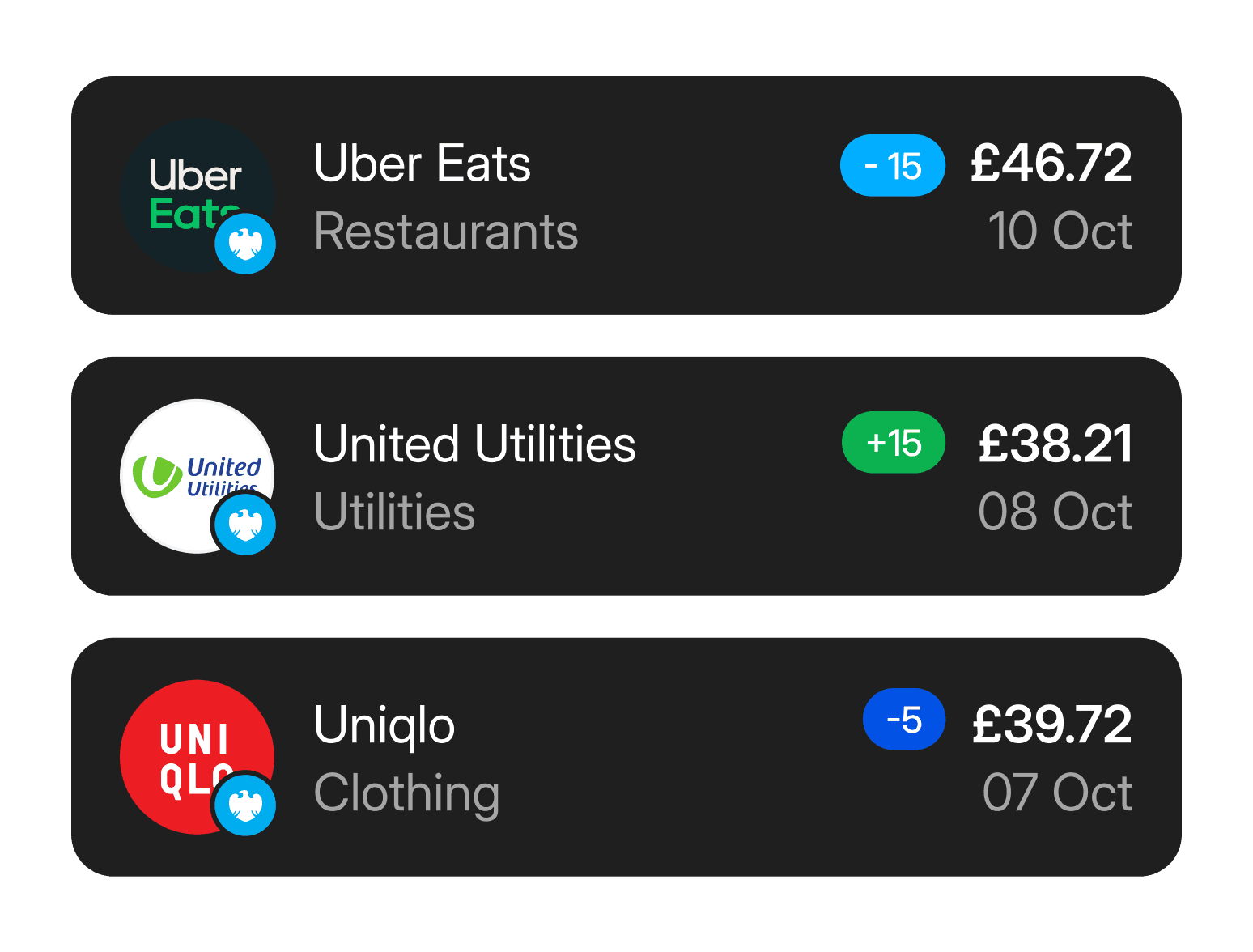

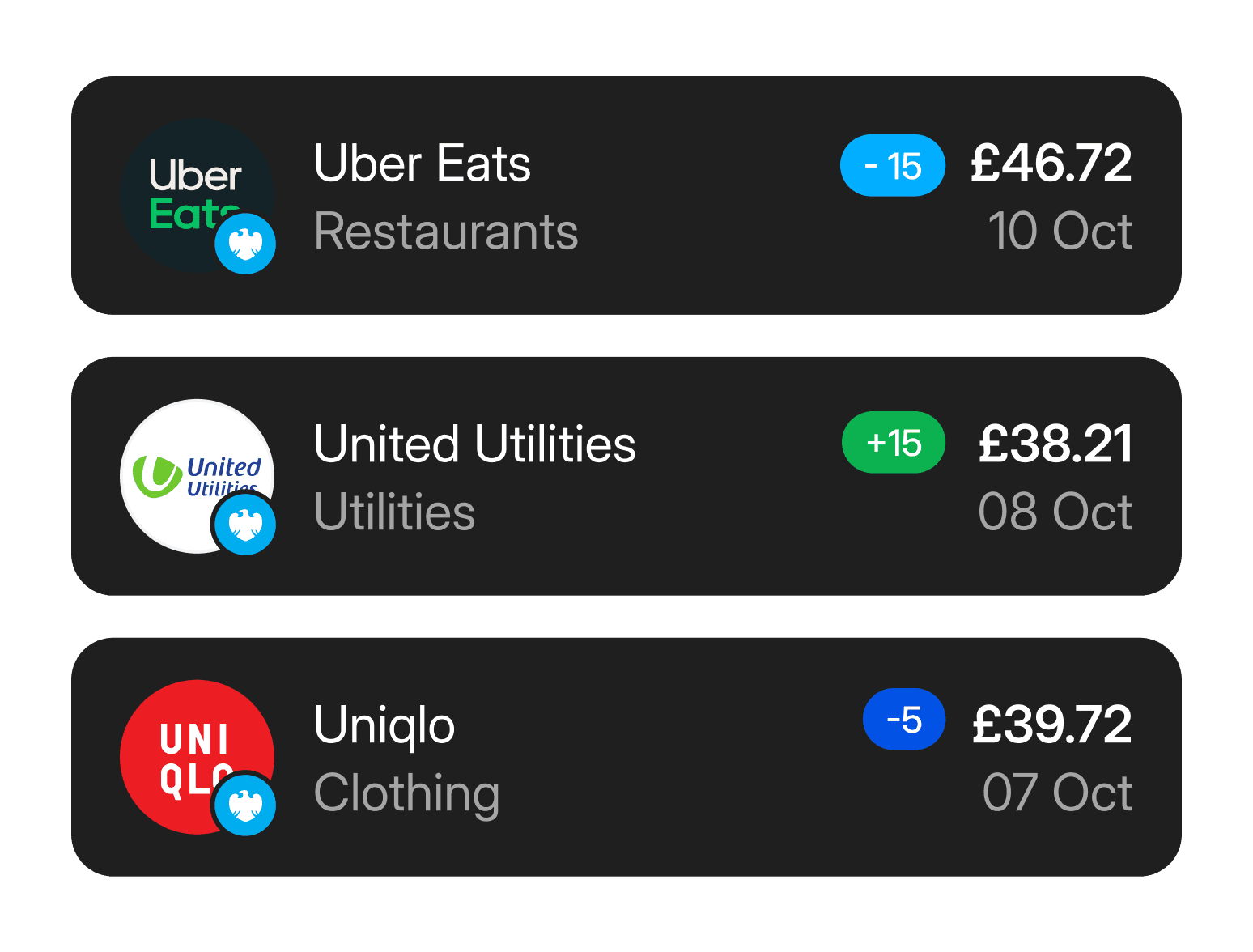

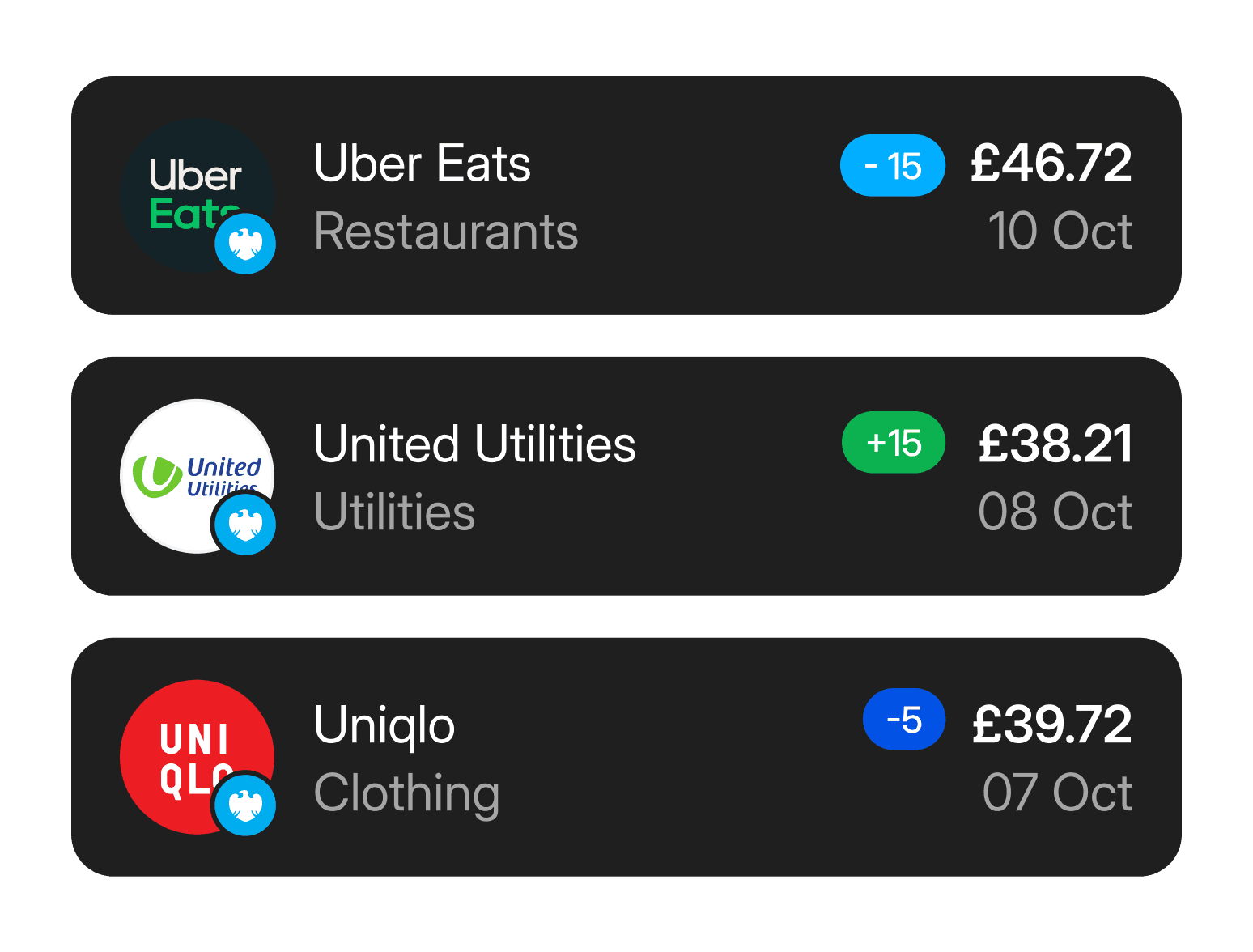

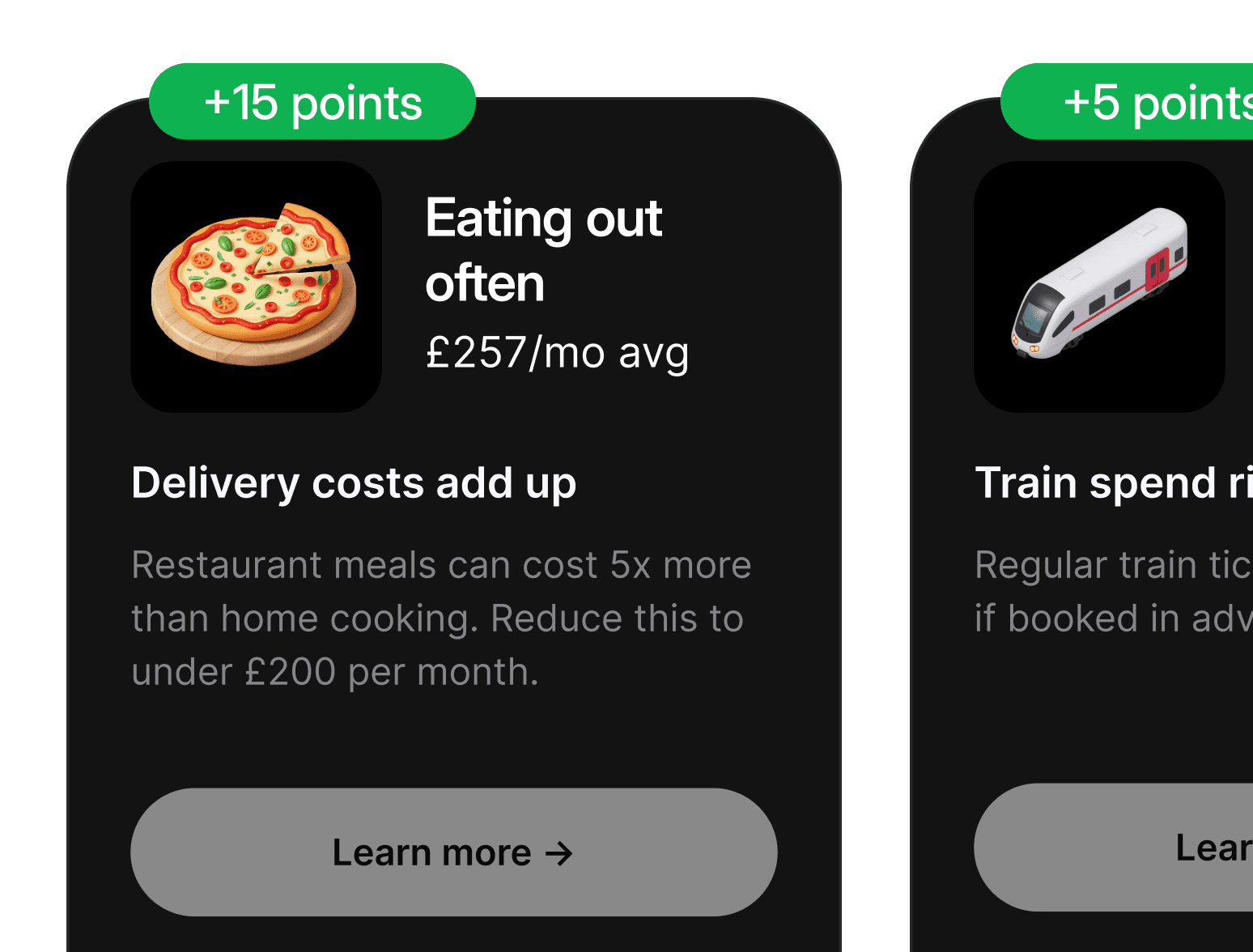

Spending behaviour

What you spend on essentials vs flexibility, and how steady it is.

Spending behaviour

What you spend on essentials vs flexibility, and how steady it is.

Spending behaviour

What you spend on essentials vs flexibility, and how steady it is.

Balances & buffer

How much buffer you have after bills and everyday costs.

Balances & buffer

How much buffer you have after bills and everyday costs.

Balances & buffer

How much buffer you have after bills and everyday costs.

Financial resilience

How well your finances could cope if things changed.

Financial resilience

How well your finances could cope if things changed.

Financial resilience

How well your finances could cope if things changed.

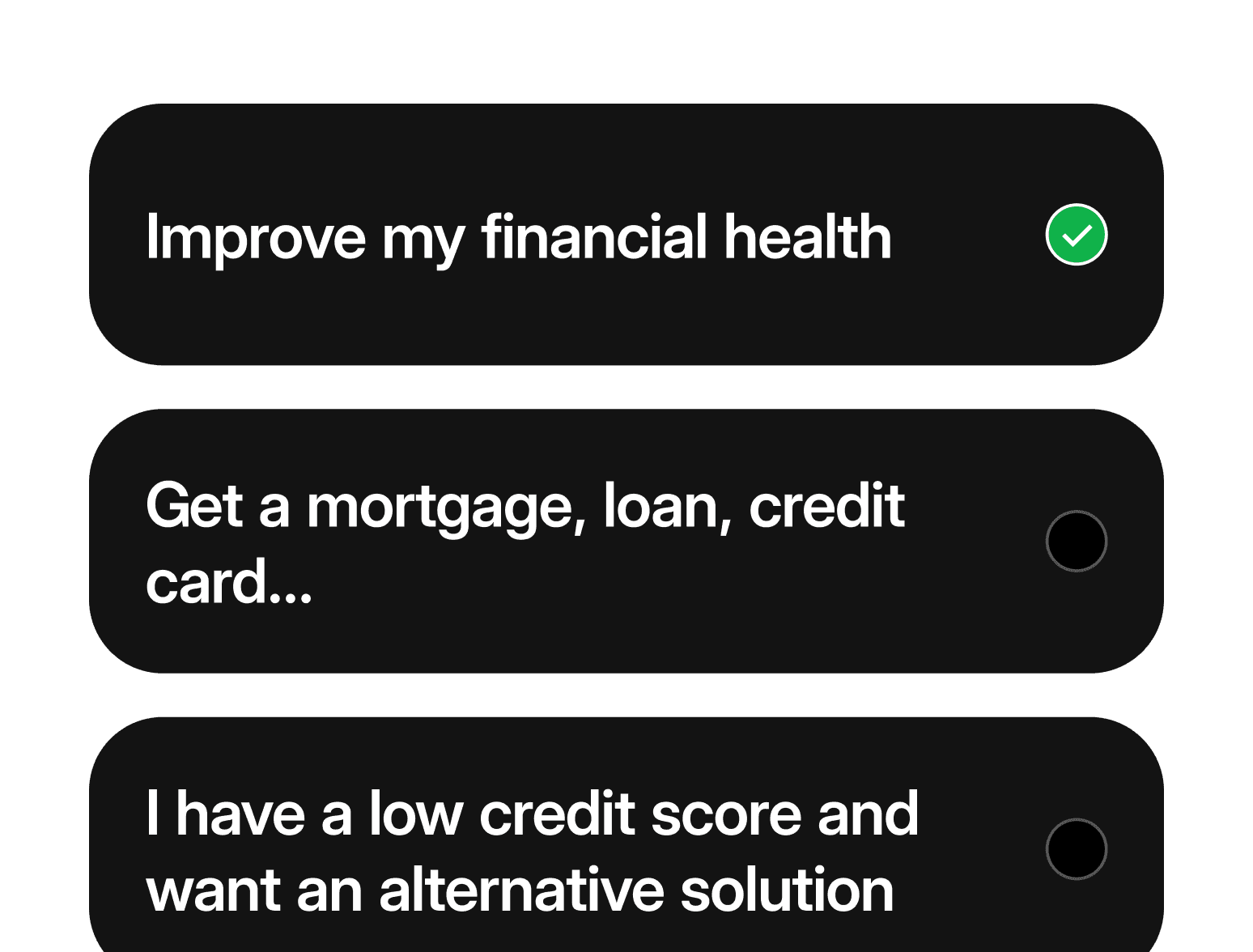

What Debit Score helps you do

No hacks. No gaming. Just clarity.

What Debit Score helps you do

No hacks. No gaming. Just clarity.

What Debit Score helps you do

No hacks. No gaming. Just clarity.

Recognition for good habits

Have responsible money management reflected, even with little credit history.

Recognition for good habits

Have responsible money management reflected, even with little credit history.

Recognition for good habits

Have responsible money management reflected, even with little credit history.

Understand affordability

Get a clear picture of what’s realistic for you, based on your actual income, spending, and bills.

Understand affordability

Get a clear picture of what’s realistic for you, based on your actual income, spending, and bills.

Understand affordability

Get a clear picture of what’s realistic for you, based on your actual income, spending, and bills.

See where there's flexibility

Understand where your money has breathing room, and where it doesn’t, without guesswork.

See where there's flexibility

Understand where your money has breathing room, and where it doesn’t, without guesswork.

See where there's flexibility

Understand where your money has breathing room, and where it doesn’t, without guesswork.

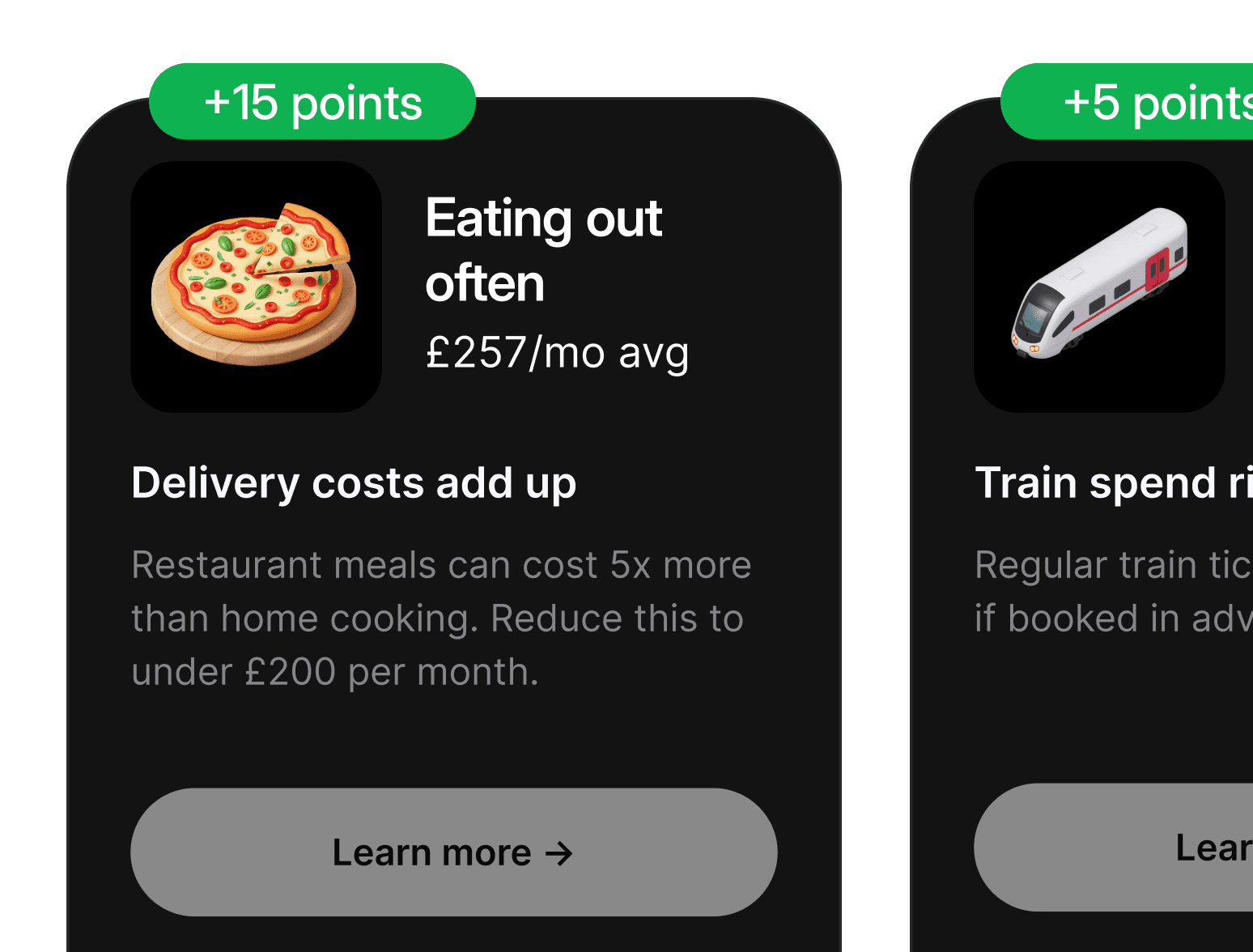

Make sense of finances

See how everyday decisions affect your financial health in a way that’s easy to understand.

Make sense of finances

See how everyday decisions affect your financial health in a way that’s easy to understand.

Make sense of finances

See how everyday decisions affect your financial health in a way that’s easy to understand.

Build better habits over time

Get simple, achievable guidance that helps you strengthen your finances gradually.

Build better habits over time

Get simple, achievable guidance that helps you strengthen your finances gradually.

Build better habits over time

Get simple, achievable guidance that helps you strengthen your finances gradually.

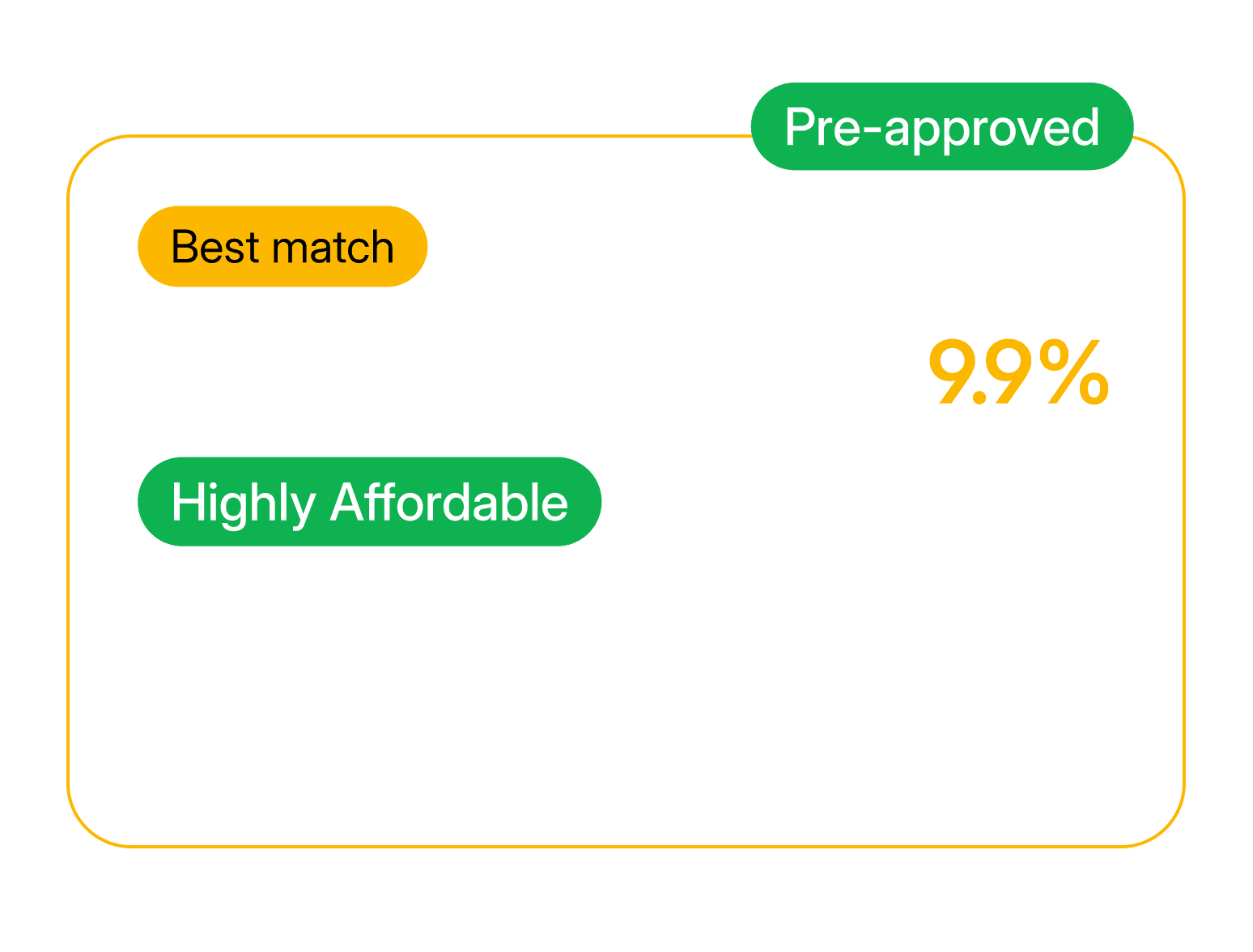

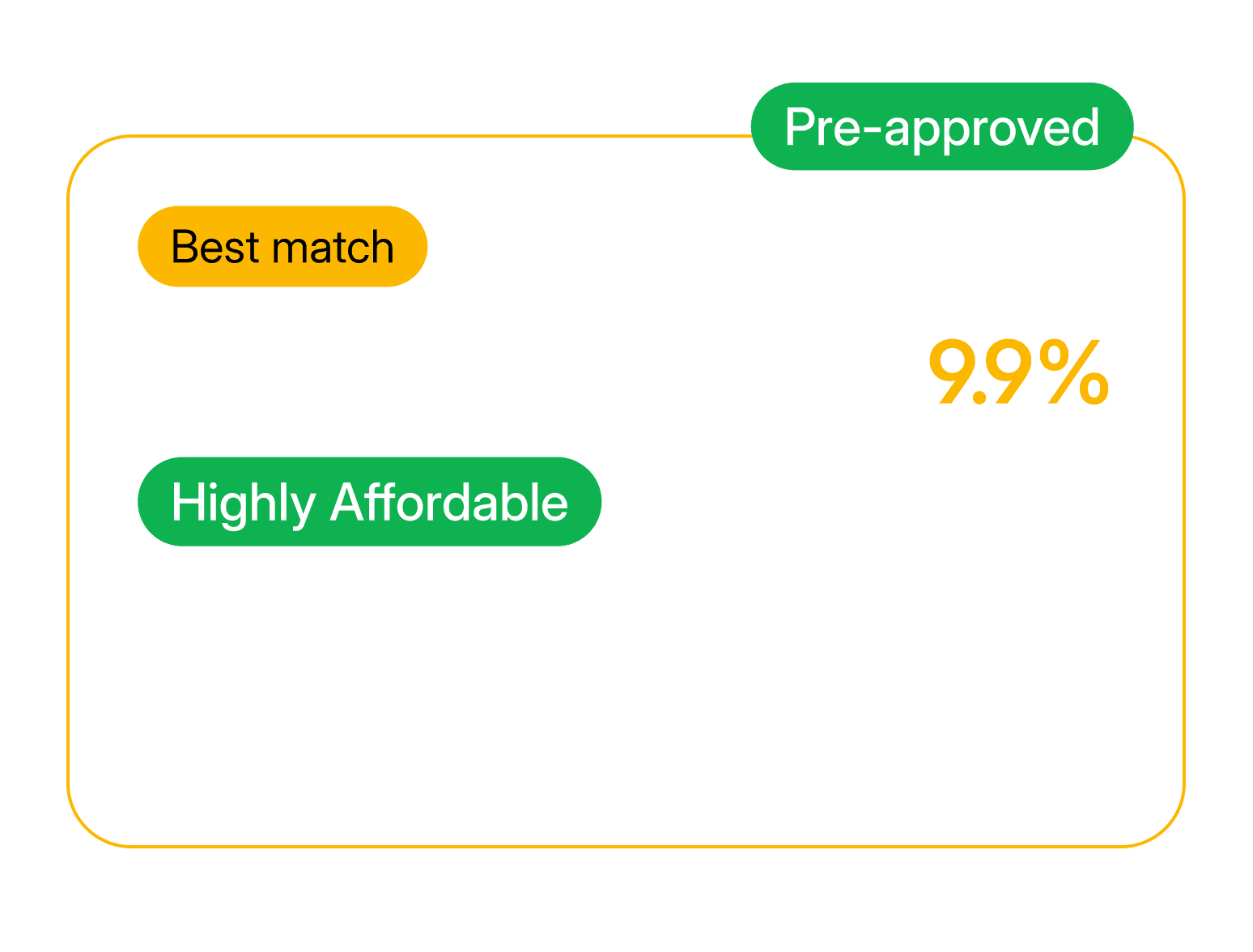

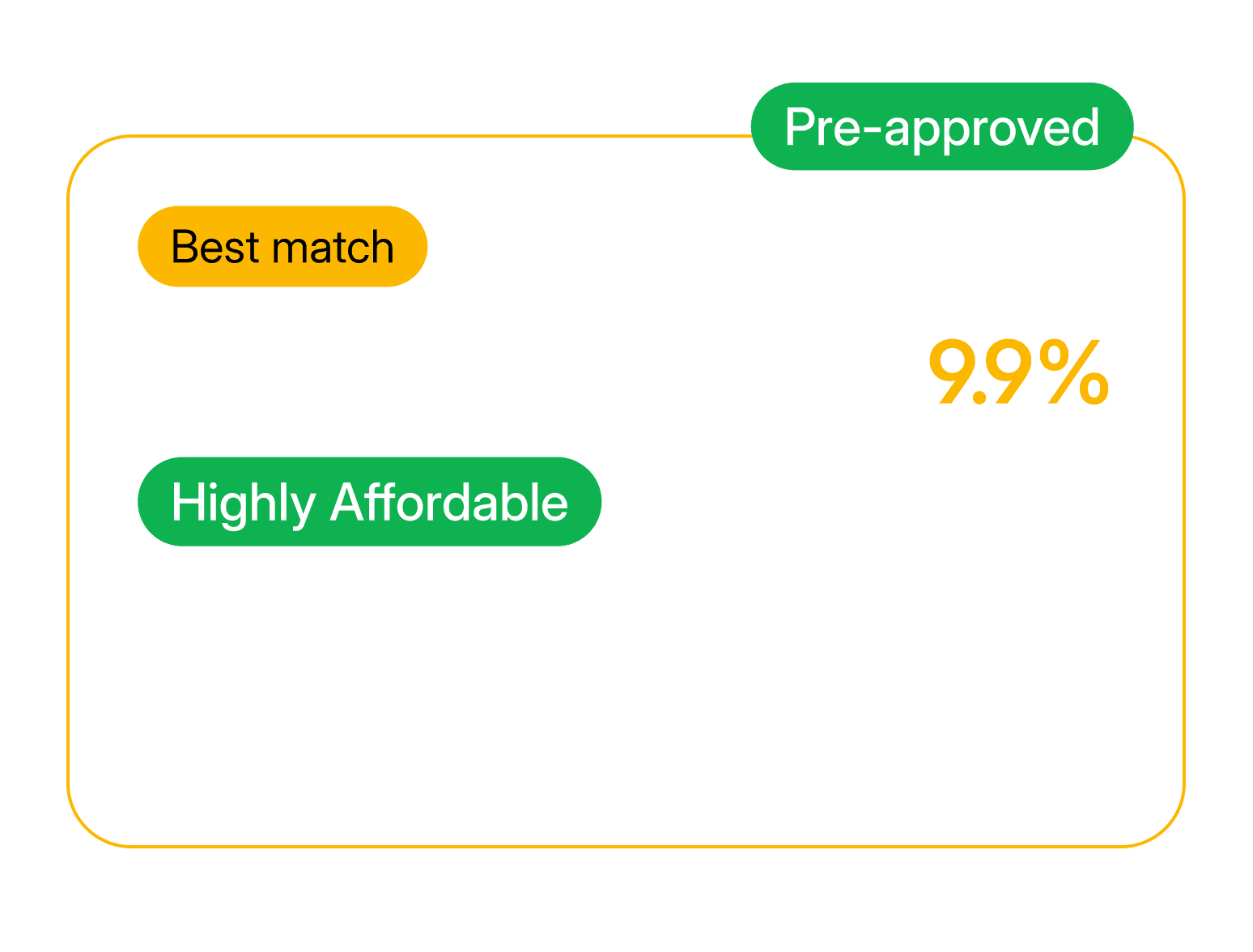

Access fairer opportunities

Put yourself in a stronger position to access financial products that fit your situation.

Access fairer opportunities

Put yourself in a stronger position to access financial products that fit your situation.

Access fairer opportunities

Put yourself in a stronger position to access financial products that fit your situation.

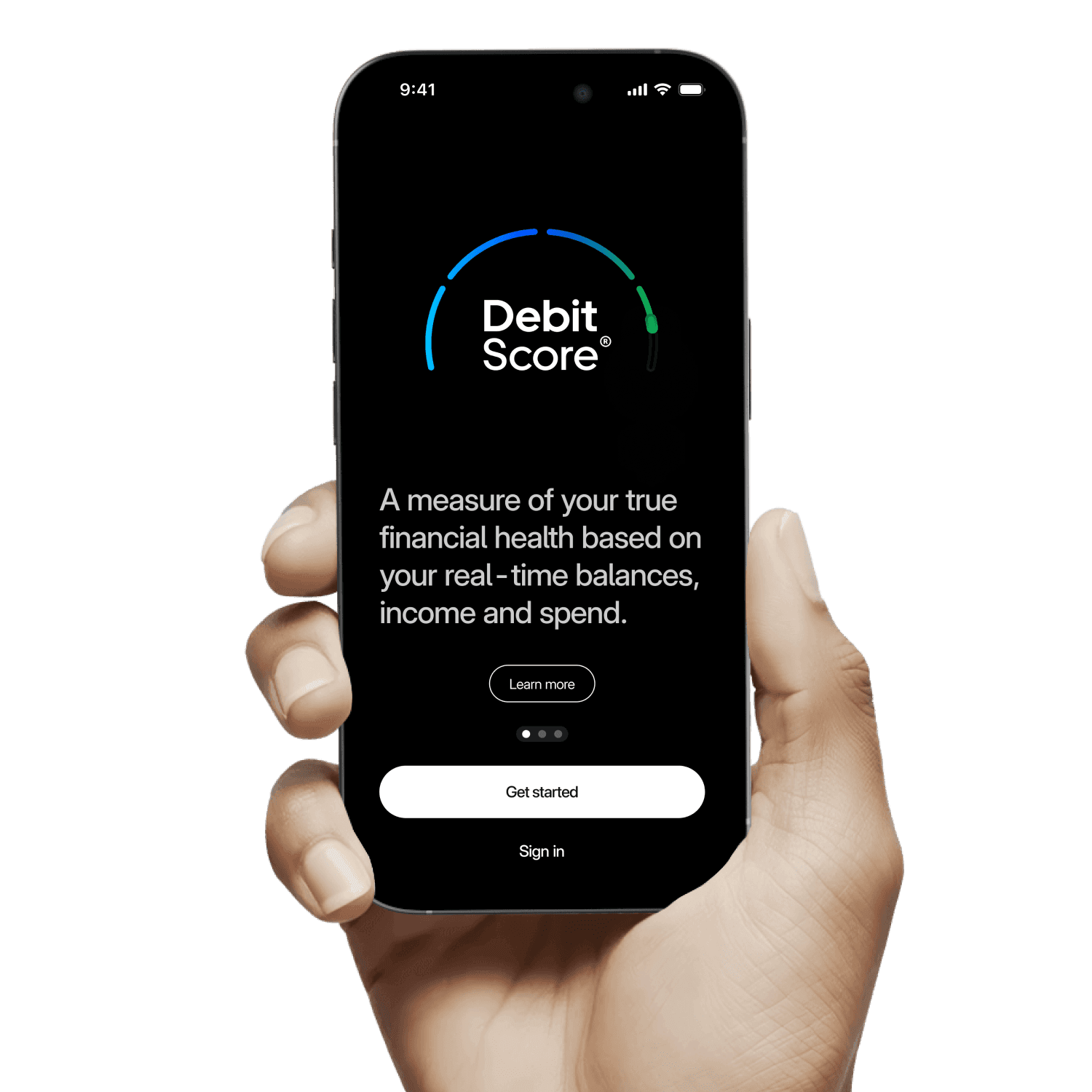

How it works

How it works

How it works

Get the app

Download the free Debit Score app when it becomes available on your device.

Get the app

Download the free Debit Score app when it becomes available on your device.

Get the app

Download the free Debit Score app when it becomes available on your device.

Connect your bank

Securely link your bank account using Open Banking.

Connect your bank

Securely link your bank account using Open Banking.

Connect your bank

Securely link your bank account using Open Banking.

See where you stand

View a clear picture of your affordability and financial resilience in minutes.

See where you stand

View a clear picture of your affordability and financial resilience in minutes.

See where you stand

View a clear picture of your affordability and financial resilience in minutes.

Improve over time

Get simple insights that help you build stronger habits and track progress.

Improve over time

Get simple insights that help you build stronger habits and track progress.

Improve over time

Get simple insights that help you build stronger habits and track progress.

Who is Debit Score for?

Who is Debit Score for?

Who is Debit Score for?

Debit Score is especially useful if:

Debit Score is especially useful if:

Debit Score is especially useful if:

You’re just starting out or new to the UK

You don’t have much credit history

Your income changes month to month

You’ve been declined and don’t know why

You want a fairer way to be understood

Early User Feedback

What people told us during early research and testing.

Early User Feedback

What people told us during early research and testing.

Early User Feedback

What people told us during early research and testing.

Appit has truly transformed my social life. I've connected with amazing people and discovered new interests. Highly recommended!

Emma Johnson

Founder at Specra

Appit’s features are fantastic for both meeting new people and staying connected with existing friends. It’s a must-have app.

David Wilson

Founder at Boom

The intuitive design and smart features of Appit made it easy to find meaningful connections. It's become my go-to app.

John Doe

Founder at Nova

I’m amazed at how Appit’s advanced privacy controls and customizable features have enhanced my online social experience. Truly innovative.

Laura Martinez

Founder at Comet

View All Testimonials

Appit has truly transformed my social life. I've connected with amazing people and discovered new interests. Highly recommended!

Emma Johnson

Founder at Specra

Appit’s features are fantastic for both meeting new people and staying connected with existing friends. It’s a must-have app.

David Wilson

Founder at Boom

The intuitive design and smart features of Appit made it easy to find meaningful connections. It's become my go-to app.

John Doe

Founder at Nova

I’m amazed at how Appit’s advanced privacy controls and customizable features have enhanced my online social experience. Truly innovative.

Laura Martinez

Founder at Comet

View All Testimonials

Debit Score helps me understand, manage and improve my day-to-day finances with updates that reflect my income, spending and balances

Lloyds Customer

Intentionally Debt Free, Age 25

Debit Score is a real alternative to credit rating - a potential lifeline

Lloyds Customer

Single Parent, Age 29

This is a real opportunity to show good financial behaviour

Lloyds Customer Survey

Recent Graduate, Age 23

This addresses an issue with credit scoring and fulfils a key need for those excluded by traditional scores

Lloyds Customer Survey

New to UK, Age 28

This fits well with looking for financial products from my bank

Lloyds Customer Survey

Gig Economy Worker, Age 36

It gives access to financial products that I would normally not have access to

Lloyds Customer

Freelancer, Age 34

This feels really helpful, being considered by lenders because of good behaviour

Lloyds Customer Survey

Recovering from Debt, Age 41

Frequently Asked Questions

Frequently Asked Questions

Frequently Asked Questions

Is Debit Score really free?

Will checking my Debit Score affect my credit score?

Is my banking data safe?

Who can see my Debit Score?

When will the app launch?

Is Debit Score really free?

Will checking my Debit Score affect my credit score?

Is my banking data safe?

Who can see my Debit Score?

When will the app launch?

Is Debit Score really free?

Will checking my Debit Score affect my credit score?

Is my banking data safe?

Who can see my Debit Score?

When will the app launch?

Be one of the first to try Debit Score

We’re launching in the UK soon. Join the waitlist to:

Get early access • Help shape the product • Get launch notifications

No spam. No obligation. Opt out anytime.